Seemingly everyone is getting aboard the subscription-model gravy train. Is it the next engine of revenue growth?

If you’re of a certain age (or perhaps even not then), you’d recollect when Facebook professed its commitment to always being free on its sign-up page.

While its core offering is still free, that’s a far cry from the option it has now rolled out to get a “verified” account by paying $11.99 a month. It’s a new pay-to-play model, that gets you better customer service, better visibility for your posts, and the all-important blue badge next to their name. Instagram and Facebook users can make full use of this, and as you can imagine a lot of users have had their head turned by it.

Facebook (or Meta, as they would have you call it) is not the only one to embrace this model either. While many will point at Elon Musk’s Twitter Blue service that recently relaunched, you can go even further back in time to pinpoint the emergence of this trend with Snapchat+. For $3.99 a month, users could ride the wave of being placed more prominently in user feeds, and enjoy the social validation that comes with the heightened visibility.

Necessity is the mother of subscription

It’s no surprise to see so many social media networks go this route. As ad-supported networks, it would only have been a matter of time before those at the helm of these businesses decided they wanted to diversify their revenue streams. This was accelerated when Apple changes how iOS managed consumer privacy and put the power to block tracking in the hands of users with its App Tracking Transparency (ATT) feature. Inevitably, this saw social media platforms like Facebook, Twitter, TikTok, and others are losing revenue due to the stronger privacy measures that greatly limited personalised advertising.

Given how targeted ads are a big source of revenue for social media platforms, ATT (and remains) a big deal. Talking about its impact in 2022, Meta claimed this feature will decrease sales in 2022 by about $10 billion. Snapchat and Twitter are no different, given the dependency on the ad-revenue model. The effect of implementing ATT was seismic; according to Flurry Analytics, only 4% of iPhone users in the US and 12% worldwide opted in to app-tracking measures.

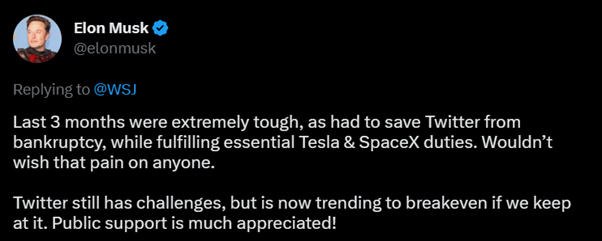

As targeted advertising fell off a cliff, companies inevitably cut back on ad spends, leading us to a sharp decline in revenues. Meta reported falling revenue in each of the past three quarters; Snap, owner of Snapchat, has lost nearly 90% of its market value in the same period. And Twitter, if Musk’s latest public proclamations are to be taken at face value, is “trending to breakeven” having previously faced bankruptcy.

The years of breakneck revenue growth fuelled by online advertising was bound to end sooner or later, but few expected it to happen so soon.

A tech tug of war

A new idea it may be, but paid subscriptions can only do so much to cover the shortfall from ad revenues. According to Snap, less than 1% of its app’s 375m daily users (it has 2.5 million subscribers). At its advertised rates, this translates to annual revenue of $120 million at most. That represents less than 3% of its total revenue in 2022. Such figures are not publicly available for Twitter or Meta.

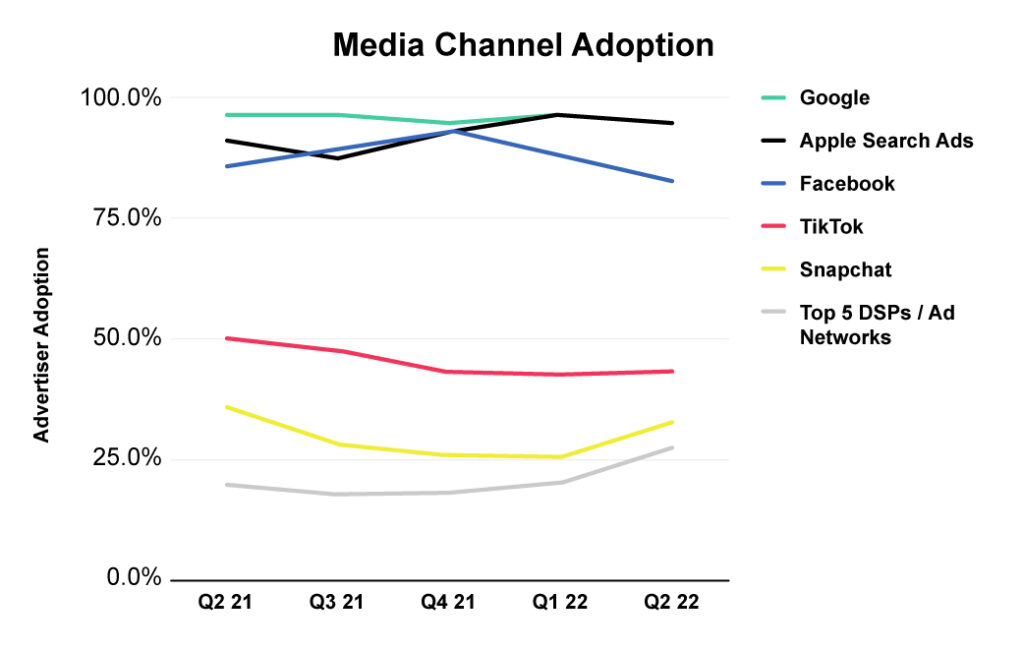

Google and Apple are two tech companies that won’t be complaining about the rise of a subscription-driven revenue model. As the mobile platforms that host these apps, they are entitled to a slice of these subscription revenues, and these events have perhaps benefited Apple the most. According to a review by the performance insights platform InMobi’s Appsumer, Apple’s Search Ads business has now joined the Facebook-Google advertising duopoly after growing its adoption by 4% to reach 94.8% year-over-year, while Facebook’s adoption dropped 3% to 82.8%.

There is a caveat to this though; as an example, users signing up for Meta’s service will be charged $14.99 via the app as opposed to $11.99 via the web. That has caused critics such as Musk to be vocal, calling the extra $3 Apple charges to subscribe to this via iOS a “30% tax on the internet”. Apple has form for this type of differentiated pricing, which forms the crux of its legal tussle with Epic Games, with Apple blocking Fortnite after Epic told users they could pay less by using a browser instead of the app, driving users to its own website.

We haven’t seen the last of these debates as these companies tussle for supremacy, with much more expected in the coming months. Now if you excuse us, we’re about to go implement our own paid subscription model at the earliest. So read this article while you still can.