After a rollercoaster 2022, what does 2023 hold in prospect for the Asia-Pacific economy at large?

2022 was something of a tumultuous year for the global economy, and Asia was no different. But as it emerges from the turbulence of the year gone by, perhaps clear skies could be in the offing as global financial conditions have eased, food and oil prices are down, and China’s economy has shown a faster than expected rebound.

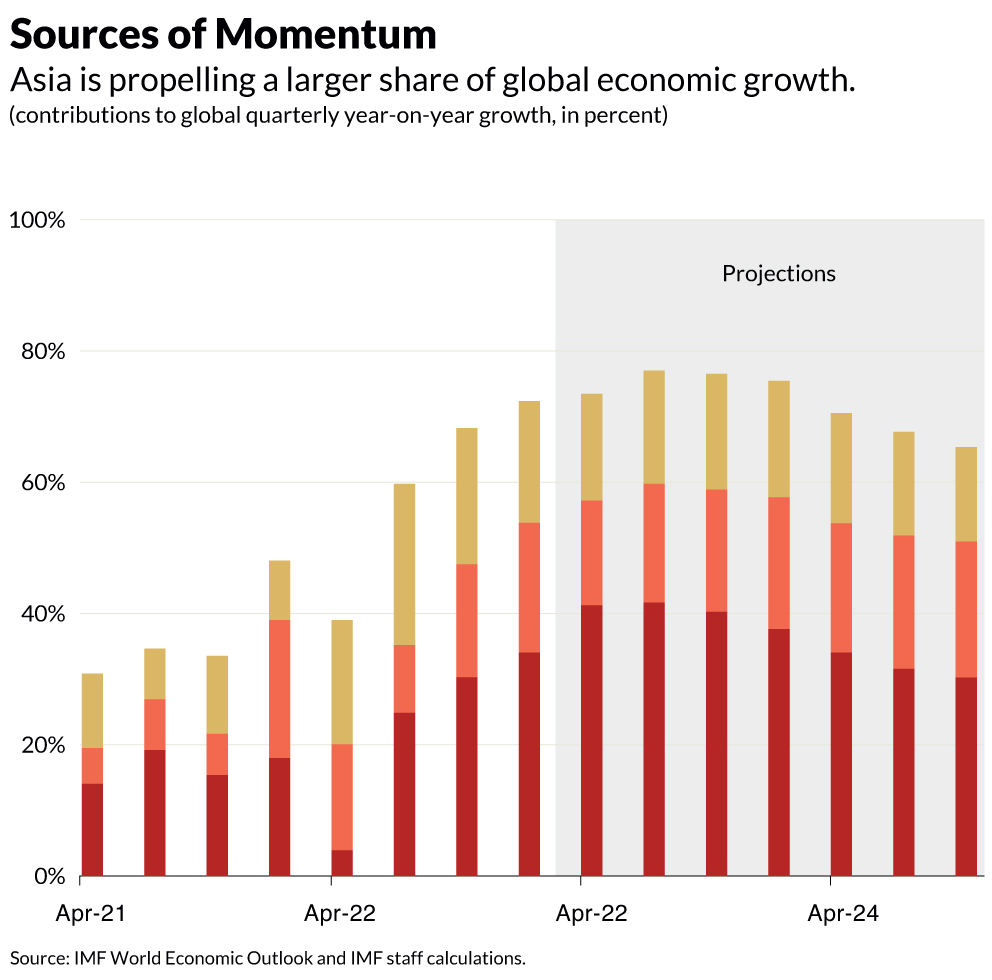

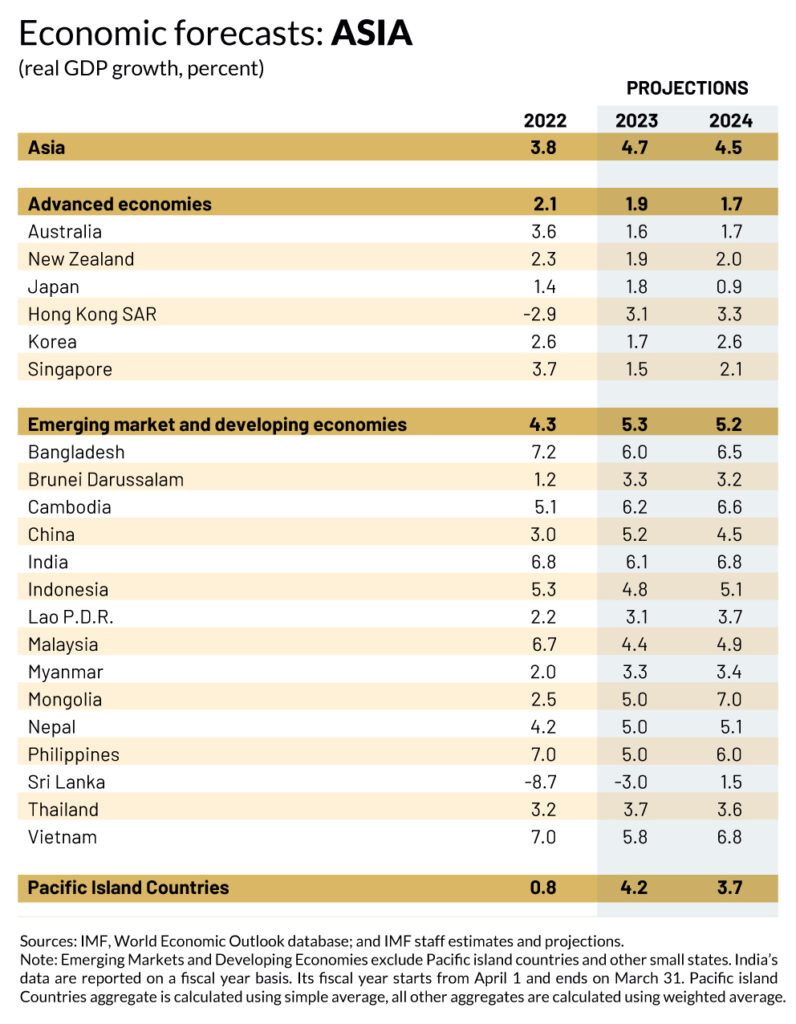

Buoyed by China’s pivot post its zero- COVID programme, the region, whose major economies shrugged off the slow growth that gripped the rest of the global economy, is poised to accelerate to growth levels of 4.7% this year, up from 3.8% in 2022. This makes it a bright spot in a global economic scenario, with the global economy set to grow by just 2.9% in 2023. This makes Asia the engine of global growth, with industries revving

up as pandemic supply-chain disruptions fade and the service sector booms. China and India are expected to form more than half of global growth projections for 2023, with the rest of Asia following their lead and contributing an additional quarter.

Growth in the offing

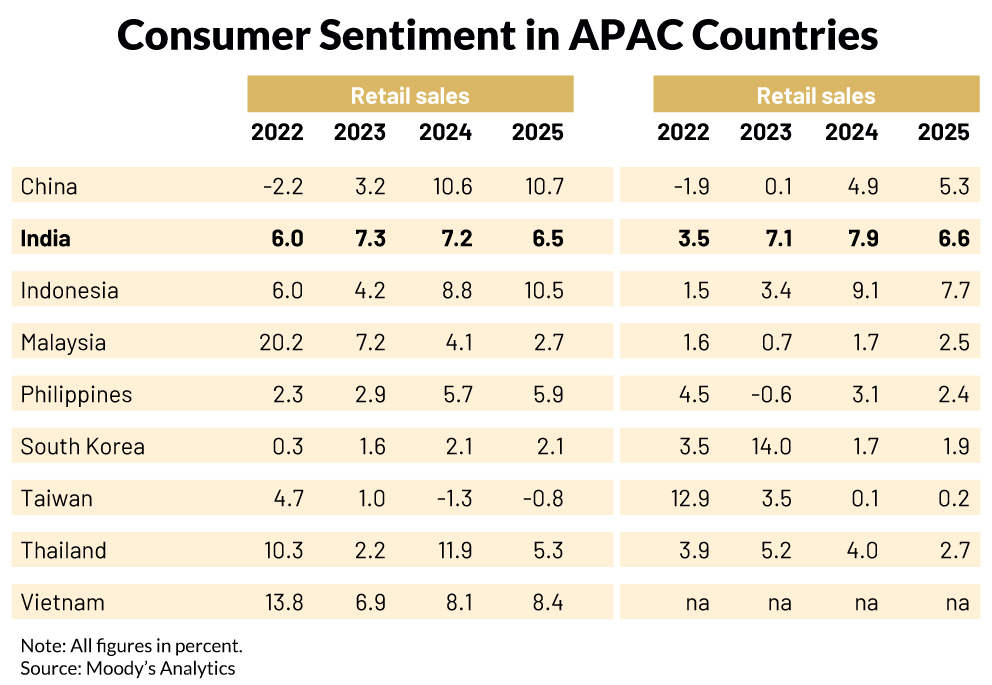

China’s recovery augurs well for the region at large, with research indicating that for every percentage point of higher growth in China, output in the rest of Asia rises by around 0.3%. And as consumer spending is on the rise for the first time in 3 years, it can be safely said that this uptick is no flash in the pan, even if its housing market is the proverbial albatross on China’s neck.

The upside of this will certainly be felt in the near-term by economies large and small across Asia, with a friendly policy climate in countries such as Japan stoking the fires of growth, but the medium-term outlook is not as rosy. Manufacturing exports have seen something of a spoke thrown in its gears as motley factors such as slowing demand, supply chain constraints, and changing technology cycles make for a challenging macroeconomic environment. This phenomenon has perhaps been most pronounced in countries such as South Korea, Singapore, and Taiwan, where the price of microchips have tumbled, impacting exports in a manner that will be clearly visible throughout the year. But with experts projecting that any growth trough will soon be past us, external demand should reverse course and ride a crest of growth by next year as the global demand for high-tech products returns.

China is no stranger to these ripple effects either, with Chinese trade and manufacturing warming up before kicking into high gear next year. The Purchasing Managers’ Index shows improved sentiment for production and new orders, even if the export order book is yet to be fully filled in. This is not expected to improve until 2024, with demand still lukewarm in Europe, North America, and even itself for now. However, Chinese manufacturers are

expected to stabilise regional trade this year.

Cooling of inflationary pressures

Inflation across Asia rose above target levels last year, although this is now expected

to normalise amid an easing of financial and commodity headwinds. Topline inflation

peaked around mid-2022 in the tech and finance-oriented economies of Singapore,

South Korea and Taiwan, Thailand, and India. Experts note that the signs are largely

encouraging, although core inflation is proving more persistent and has

yet to ease off. Calibrating policy responses to this is a challenge, as the pandemic

created some lasting changes that are yet to be fully explored by policymakers.

Further, a surge in demand in China will spur its own inflation rate, with the

velocity of this upward trjectory possibly stymieing disinflation in the APAC region.

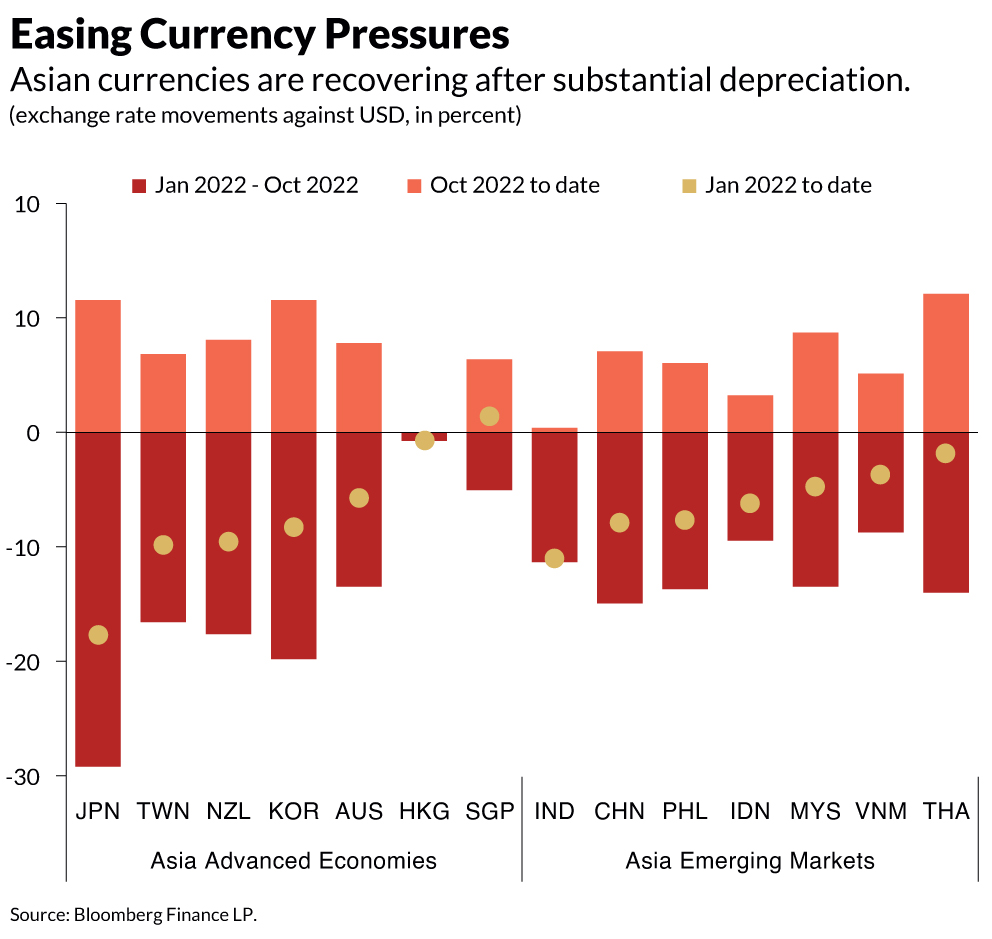

Central Banks across Asia have hiked interest rates in an effort to rein in inflation, and this coupled with a slight weakening of the US Dollar have helped Asian currencies reverse

lost ground and relieve domestic price pressures.

This is tricky tightrope to tread, with these apex banks needing to reiterate their commitment to price stability, even going so far as to roll out further rate hikes if core inflation shows no signs of cooling down. If this comes to pass, expect it to slow down economic growth.

Cautious optimism, the order of the day

While the short-term picture is a promising one, optimism needs to be tempered when

looking to the medium-term. With global supply chains and Asia’s own growth story

closely linked to that of China, any slowdown will hit the brakes just as much as an

acceleration will move the needle upwards. A decoupling is needed on this front, to create

greater resilience across Asia and the world and to safeguard long-term growth.

The biggest risk for this growth outlook is that of a recession in the USA and Europe. This could torpedo expected improvements in demand for goods and services beyond Asia,

impacting Asia, Taiwan, South Korea, Singapore, and India. Similarly, a ramping

up of geopolitical tensions, such as the war in Ukraine and any ensuing sanctions

or bottlenecks, could spark fresh inflationary concerns and derail growth. Lastly, there is a need for stronger systemic frameworks, with households and institutions highly leveraged and vulnerable to shocks, and the same can be said about banks thanks to their exposure to real estate. With each of these stakeholders firmly hitched to their respective wagons, the hope is that the road ahead is a smooth one and not bumpy. But given the largely robust underlying fundamentals, it can be said Asia’s growth engine is in fine health and ready to rumble after a year of running rough.