The biggest battle brewing in Big Tech is not on the ground, but for cloud supremacy

When Bill Gates said that the Internet is becoming the town square for the global village of tomorrow, even he might not have been fully aware of just how prescient his statement was. In the decades since its unveiling, it powers virtually every facet of our lives, and underpinning it all is the Cloud. That great, invisible being that serves us everything digital on a silver platter.

And it’s not just the delivery of content and a multitude of services; the Cloud has also come to be seen as the alternative to traditional enterprise computing environments, with technology advancing by leaps and bounds. Indeed, International Data Corporation (IDC) forecasts “whole cloud” spending – total worldwide spending on cloud services, the hardware and software components underpinning the cloud supply chain, and the professional/managed services opportunities around cloud services – will surpass $1.3 trillion by 2025 while sustaining a compound annual growth rate (CAGR) of 16.9%.

- Rick Villars, Group Vice President, Worldwide Research, IDC

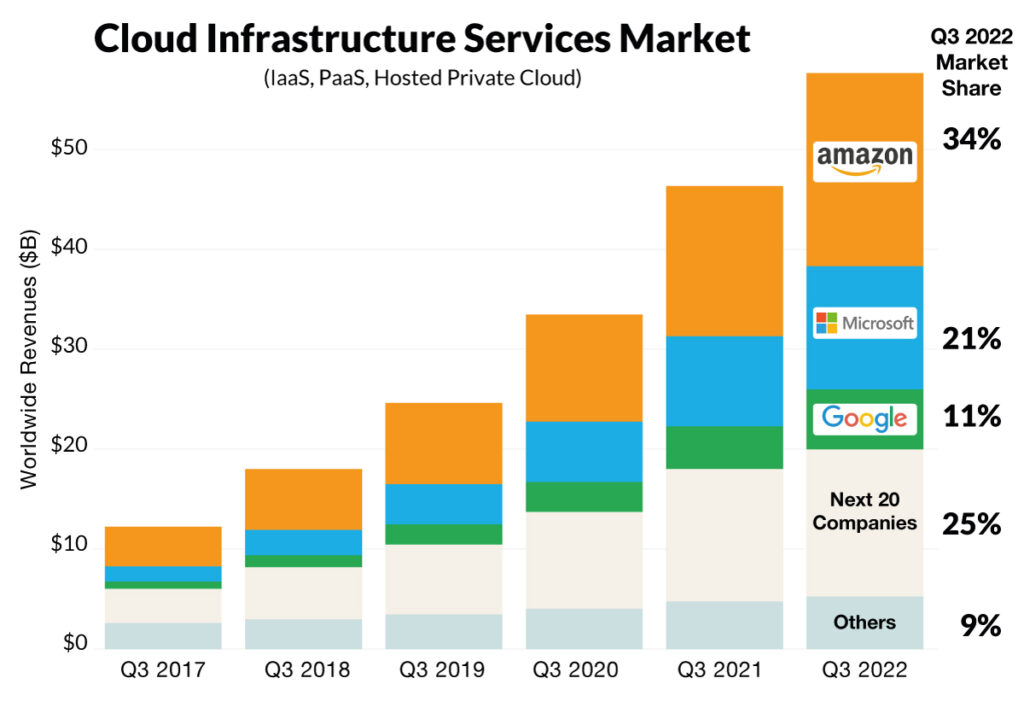

In time, the demands of a digital world have come to place an increased emphasis on the importance of the $240 billion-per-year-and-growing global industry, making it a strategic battleground of great importance. Google is the third-largest cloud provider after Amazon Web Services (AWS) and Azure (Google is the third-largest cloud provider after Amazon (Amazon Web Services or AWS) and Microsoft (Azure), and the trio of tech titans are slowly edging out competition.

Few silver linings for this cloud

For long, Google has been playing catch-up in the cloud infrastructure market, and this can be seen in the respective contributions of Cloud revenues to each respective organisation. While AWS and Azure account for over 25% and over 50% of revenues for Amazon and Microsoft respectively, Google Cloud contributes a little less than 10% to Google’s overall revenues.

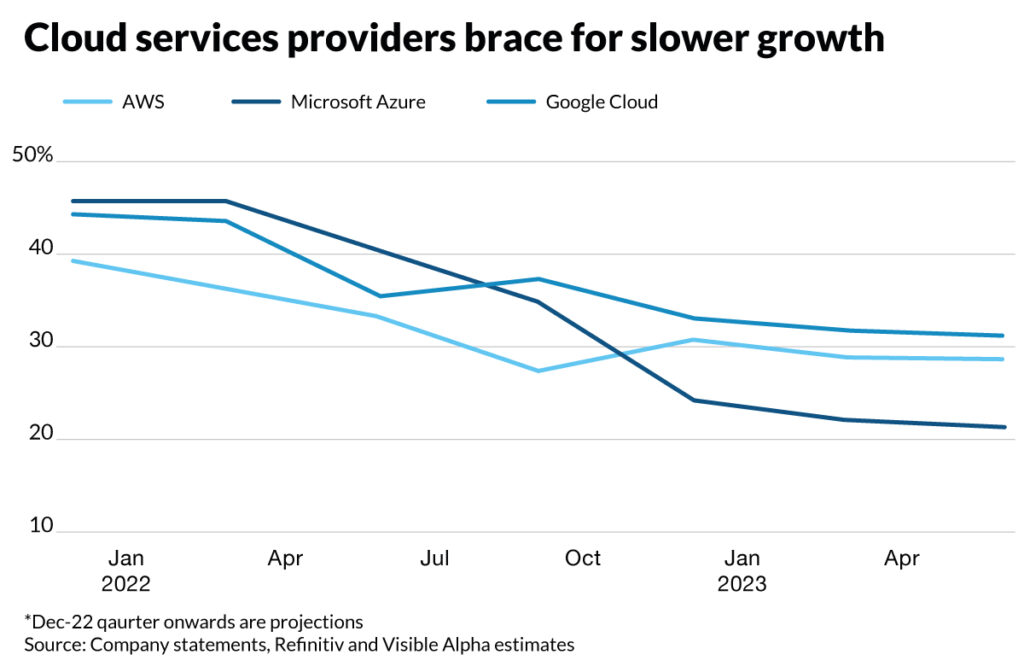

But that is just one aspect to consider. After years of growth, the sector has witnessed a slowdown, with thousands laid off and losses widening as the effects of the slowdown became apparent.

Direct comparisons between the three tech giants is made all the more difficult by the use of cloud infrastructure metrics that aren’t easily comparable. However, an internal estimate assembled by Google employees estimates that Microsoft generated under $29 billion in Azure consumption revenue in the fiscal year ended June 30, 2022. This would put the Redmond major’s cloud business at an operating loss of almost $3 billion, down from a loss of more than $5 billion the prior year.

Analysts were quick to play such assumptions down, with some, such as Derrick Wood at Cowen, saying his research shows Azure boasting an operating margin above 30%, compared with Google’s estimate of a -10% margin. For its own part, Google Cloud has enough headwinds to contend with. While the business unit’s revenue rose 36% to $6.3 billion in the quarter ended Q2 2022, its operating loss jumped to $858 million in the same period, up 45% year-on-year.

It is no surprise to see Amazon offer the clearest picture of its revenue and operating income for AWS, with the company controlling 33% of the global cloud infrastructure market, and recording an operating margin of 26% in Q3 2022.

The case for AI

Unless you’ve been living under a rock, ChatGPT is an AI tool that has captured the collective imagination in a way few saw coming. Its conversational, question-answer format makes some believe that it could one day overtake the currently undisputed king of search, Google. That could prove to be problematic, given that search ads contribute $39.5 billion (or 57.2%) of Google’s total revenue of $69.1 billion (as of December 2022).

Given the threat of an impending slowdown in tech, one might wonder why Microsoft invested $10 billion in OpenAI, ChatGPT’s developer, just days after it announced plans to lay off 10,000 employees. Those layoffs come in the wake of a tech slowdown, as Microsoft’s cloud business has barely beaten analyst’s growth projections, a recessionary pinch has seen consumers postpone purchases, leading to its slowest sales growth in six years with net income shrinking across hardware and software for the quarter ended December 2022.

Microsoft’s big play here is not just to get a massive early mover advantage in the AI landscape, but because of how tools like ChatGPT and DALL-E could dovetail with Azure and give it a further advantage in the cloud computing space over competition from Google, Amazon, and even Meta (nee Facebook), besides strengthening core products such as Word, Powerpoint, and Outlook. While DALL-E can generate realistic images based on a handful of words, ChatGPT can create conversational responses in a way Google Search simply can’t, and this infusion of cash from Redmond will help OpenAI crunch the massive volumes of data and run the increasingly complex models that underpin these services. All while potentially undermining competition.

“We formed our partnership with OpenAI around a shared ambition to responsibly advance cutting-edge AI research and democratise AI as a new technology platform,” Satya Nadella, Microsoft’s CEO, said in a statement, saying advances in AI are the “next major wave” of computing.

Clearly, Google concurs. ChatGPT’s rise has raised alarms that have led to the return of Co-Founders Larry Page and Sergey Brin in what can only be dubbed an exceptional move that underlines the extent of the threat perceived.

It’s unusual to see Google’s founders involved with the search engine side of the business. The duo had taken a more hands-off approach since stepping down, although they were long keen on bringing A.I. into Google’s products, according to the New York Times. This move potentially signals a change of plans, and a shift to incorporating AI more rapidly and extensively into Google products.

The Times reported that Brin and Page notably approved projects and ideas advocating for adding AI and more chatbot features to Google’s search engine, the newspaper said, in addition to providing advice to current leaders who have made artificial intelligence the priority of their strategy. In addition, they reviewed the AI products the company is working on. The Times went on to say that Google now intends to unveil more than 20 new products and demonstrate a version of its search engine with chatbot features this year, citing people in the know.

Amazon itself is a bit quieter on the AI front, although it did recently introduce norms to enhance transparency and use AI responsibly. Clearly though, these moves should be enough to stir them into action too, making this a battle royale worth watching in the months and years to come.