With the chill of the much touted funding winter still felt, where does India’s startup ecosystem go from here?

We have no firm idea of the popularity of it, but we can take an educated guess and wager that the phrase “funding winter” was hotly googled in startup circles up and down the country by the end of 2022.

The period of discontent, which began in 2022, seems to show no signs of dissipating in early 2023, as companies struggle to find funding amid a period of sustained global inflation, interest rate hikes, and macroeconomic headwinds that have left investors wary of the future.

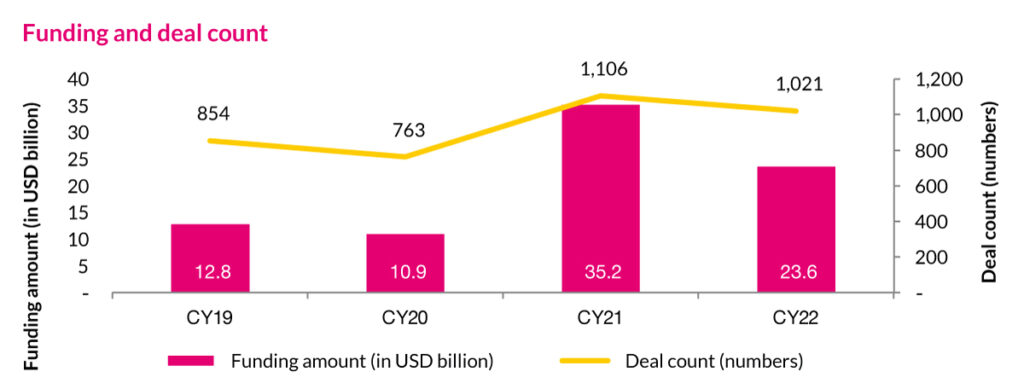

According to a report by PwC India, funding for Indian startups dropped 33% to $24 billion in 2022 from the previous year. However, to put things in perspective, this was still more than twice the funds raised in CY20 (~USD 10.9 billion) and CY19 (~USD 12.8 billion. The report said the early-stage deals accounted for 60-62% of the total funding in 2021 and 2022 in volume terms, and the average ticket size was $4 million.

Clearly then, 2023 is also about being pragmatic about tight purse strings (which is what led to the many layoffs we’ve seen as valuations shriveled) and extending the runway as far into 2023 as possible.

So what’s next for India’s startup ecosystem?

2022, by the numbers

The past one year has been a concerning one, with the funding crunch putting something of a kibosh on India’s startup growth story. In 2022, funding in Indian startups dropped by almost 75% over 2021, and the trend continued into 2023, with a 70% fall in funding for Indian startups in January at $1.38 billion, as per Tracxn data.

If private wealth management firm Bernstein is to be believed, it predicts that Indian internet companies may face funding challenges for the rest of the year, which may lead to market share gains for segment leaders such as Nykaa and Zomato.

Some key considerations:

The numbers don’t make for terrible reading, but keep in mind that they have been bolstered by a huge influx of capital in the first quarter, when five of the top six startup investment deals of 2022 were sealed. Things tailed off dramatically in April, and it has shrunk further with each passing quarter. Crunchbase observed that the third quarter of 2022 logged the lowest venture capital funding in India since the start of 2020, at USD2.9 billion.

One thing is clear; as valuations tumble, the time of easy money is no longer on the cards, and cost-cutting measures might well weigh on business growth.

The road ahead

Without a runway extending beyond 12 months, the road ahead might be a grim one for startups. Some are going back to the drawing board, and facing tough conversations and negotiations, with internal bridge rounds, flat rounds, and down rounds of approx. 20-30% relative to previous valuations on the cards.

A correction might be impending in 2023, but that isn’t necessarily a bad thing as it will set the stage for a renaissance later in the year, with venture capital firms waiting to deploy their funds strategically. India-focused venture capital firms have raised USD 5.5 billion worth of new funds in 2022 alone, which has to be invested in the medium term. Hence their patience won’t be endless. What they are perhaps waiting out is a stemming of systemic rot, and weeding out ventures with high burn, slow growth, and short on cash at hand.

Speaking in New Delhi, Deborah Quazzo, Managing Partner at US-based GSV Ventures, which has backed edtech unicorns such as Eruditus, PhysicsWallah, and Lead in addition to global edtech firms like Coursera, Class Technologies, Degreed, commented that “it’s slower and natural” to see venture funding trickling down, but was quick to point out the difference in the current downturn compared to the slowdown of 2000 or 2008.

“It was an environment where it was easy to raise capital and companies were not seeing a lot of friction and in doing that, and sometimes that causes a different approach to building your business. A lot of companies (now)–compared to 2000 or 2008 are very well-funded. So, it’s been a matter of pulling back and having adequate runway and having your business model honed in a way that you can look forward towards profitability and not be wholly dependent on capital markets for funding.”

Dubbing this slowdown as healthy and beneficial, Quazzo said it will make startups “reassess their models” and work with profitability in mind without being completely dependent on capital markets. She expects the pace of investments to remain muted in the USA and India for the rest of the year at least.

The timing of Quazzo’s comments are opportune as India’s edtechs have struggled to maintain the same growth momentum they enjoyed amid the pandemic, epitomising at a broader level how the current environment lays bare which companies have agility and flexibility and can think on their feet, “and can pivot if they need to. It’s an important environment for companies to live through, and it’s an important environment for investors to be really supportive”.

The time for easy money might be behind, but bear in mind that tough times don’t last, tough people do. It’s hard to see the light at the end of this tunnel, but those that emerge into the light will be stronger for the experience, with high-quality metrics to boot.