We caught up with the renowned Infosys Co-Founder to understand his thoughts on the status quo of India’s dynamic startup ecosystem

Words by Sakshi Dhingra and Karan Karayi

When one speaks of the success story of India Inc. on the global stage, it is inevitable that Infosys’ name crops up. Theirs is the classic story of an idea that exploded to life and earned acclaim, with the company brought to life in 1981 with a seed capital of a mere ₹10,000 now enjoying revenues of a dizzying near ₹38,000 crores (as of June 2023).

Not every company has a tale as romantic as that, and it’s not every day that one gets to have a conversation with one of its co-founders about the startup landscape in India, and where it’s headed. So when we got a chance to pick Senapathy ‘Kris’ Gopalakrishnan’s brain, you best believe we grabbed it with both hands.

Formerly Vice Chairman of Infosys from 2011 to 2014, Gopalakrishnan served as its CEO and MD from 2007 to 2011 before going on to co-found Axlior Ventures in 2014, a venture capital platform for young entrepreneurs. He’s been voted the top CEO (IT services category) in Institutional Investor’s inaugural ranking of Asia’s Top Executives, and was also also selected to Thinkers 50, an elite list of global business thinkers, in 2009.

Enough of the kudos though, for the list of accolades is longer than an arm’s length (the man is a Padma Bhushan awardee, after all). Let’s instead detail out his thoughts for your reading pleasure.

Pondering the startup status quo

India has always had a strong startup and entrepreneurial spirit, and this innovation economy wields the potential to drive India’s growth ambitions of being a 5 trillion dollar economy by 2030.

However, the current landscape is fraught with challenges; during the first quarter of 2023, no new unicorns emerged, unlike the same period in the previous year when 14 startups reached the $1 billion valuation milestone. This decline can perhaps be greatly attributed to the “funding winter”, as seen in Indian startups securing only $2.8 billion in funding in Q1 2023, reflecting a substantial 75% decrease compared to Q1 2022, according to a Tracxn report.

However, Gopalakrishnan is still optimistic about the road ahead. “We will see ups and downs, which is not going to be kind of a straight line, or a, a slope that’s going upwards. But over the medium to long-term, it’s a slope that’s going upwards, I’m very optimistic about the startup ecosystem in India. The reason for that is one, India is a growing economy with a large number of opportunities to innovate with emerging technologies, and new technologies are being introduced every day. Yes, this slowdown will last probably, maybe a year or so. But beyond that, I’m very optimistic. And this is based on how I’ve seen cycles play out in the past.”

Charting a way forward

The numbers around the funding freeze has been much publicised, with employee layoffs, delays in capital allocation decisions, and plummeting valuations grabbing the headlines.

But while the picturing painted around this grim winter is one of survival amidst adversity, it is also about the opportunity that lies therein. Savvy captains will get to test their mettle to navigate a way forward against a backdrop of dynamic markets and choppy sentiments, all with a view to reaching the promised land. These peaks and troughs are a universal phenomenon, equally driven by macroeconomic challenges and geopolitical catalysts.

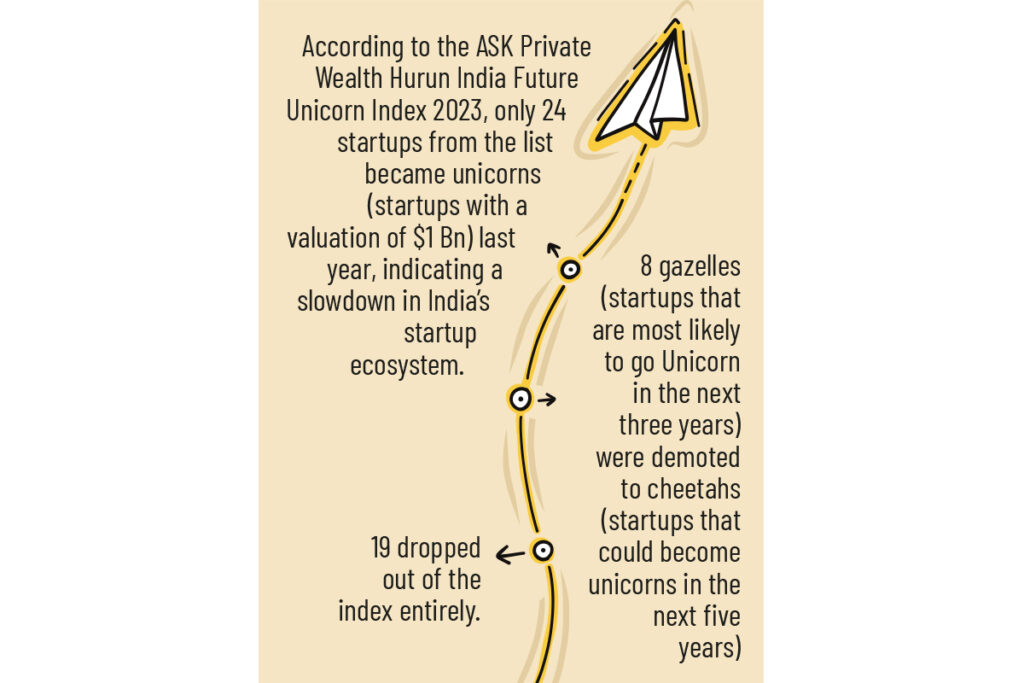

According to the ASK Private Wealth Hurun India Future Unicorn Index 2023, only 24 startups from the list became unicorns (startups with a valuation of $1 Bn) last year, indicating a slowdown in India’s startup ecosystem.

8 gazelles (startups that are most likely to go Unicorn in the next three years) were demoted to cheetahs (startups that could become unicorns in the next five years) 19 dropped out of the index entirely.

These bumps in the road for the Indian startup ecosystem can prove to be the wind in their sails, and Gopalakrishnan has some sage advice for founders looking to find a path forward. “Firstly, this is a time to conserve cash, this is a time to buckle down and stay the course so that you survive this downturn. The startups that have very good execution capabilities, those are the ones that are scalable and with growth potential. They are the ones that will survive. Those that don’t have revenues are going to find it will be challenging.”

“Second, is because of funding challenges, the valuations are down. Again, it’s a passing phase. In the public markets, you always see that valuations go up and go up and down every day. In the private markets, also valuations will go up and down. So the bottom line is, stay the course. Try and conserve your cash, make sure that you elongate your runway, make the cash go longer, and survive the downturn.”

Tough times these may be, but they can act as an impetus to take a more balanced approach, or to optimise, restructure, regroup, and rethink as a more efficient business model comes to the fore. With profitability being prioritised, this turn of events is a litmus test for startups, and those that pass it will clearly emerge winners in this hotly contested ecosystem.

Building agility, boosting resilience, and targeting profitability is the need of the hour, and Gopalakrishnan is optimistic about the future of multiple industries. “If you look at industry sectors, I’m very optimistic about IT services, about the whole biotech space, because that’s where the maximum number of opportunities are there at the intersection of biology, computer science, engineering. I’m very optimistic about automotive because Automotive is going through multiple transitions; transition to electric, transition to hydrogen, transition to autonomous vehicles, and more. So there are many sectors that I’m very optimistic about at this point of time.”

It might seem as if the gloom that hangs over the industry is endless, but the night is darkest before the dawn, heralding a spring as winter thaws. And with Kris Gopalakrishnan’s words fresh in our ears, it is only a matter of time before the third-largest startup ecosystem in the world shakes off its reverie and kicks off another cycle of high growth.