In India, the divide between the haves and the have-nots has widened to unprecedented levels. The Modi government, once touted as the champion of the middle class, has seemingly abandoned its promises of economic reform and now appears to be actively working to tilt the scales further in favour of the ultra-wealthy.

While the standard deduction limit has been raised by a measly ₹25,000 to ₹75,000, the increase in short-term and long-term capital gain tax, coupled with the removal of the indexation benefit on the sale of property means there is no respite for the common investor from inflation.

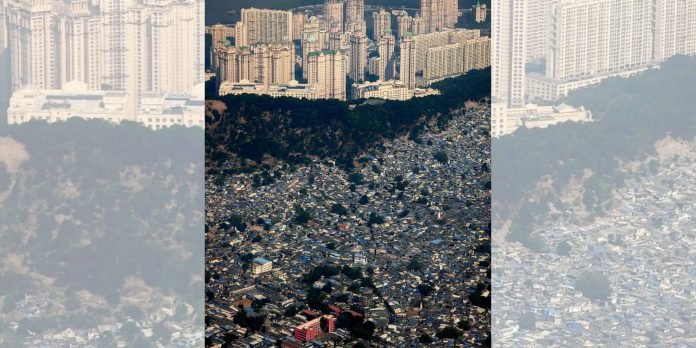

Clearly, it’s a tale of two India’s – one where the super-rich flaunt their extravagant wealth with obnoxiously lavish and frankly obscene pre-wedding celebrations that would have given Roman emperors pause for thought, and another where millions struggle to put food on the table, grappling with the harsh realities of chronic hunger and severe food insecurity.

As the Modi government looks to keep the fiscal deficit in check, it appears to have found a novel solution to this challenge: tax the middle class to the stratosphere, while showering the billionaires with even more riches.

Billionaires rule, as income inequality soars

The story of India’s inequality woes is one of two divergent trajectories. While the country’s economy has experienced impressive growth, with GDP expanding by over 7% annually, the fruits of this prosperity have been disproportionately reaped by the nation’s elite. In the decade since Modi’s rise to power in 2014, the net wealth of Indian billionaires has grown by a staggering 280% – a pace that is 10 times faster than the overall growth in national income.

Recent studies have shown that India’s income inequality is now worse than it was during the British colonial rule. The top 1% of the population now holds a staggering 22.6% of the national income, a figure that is not far from the colonial era, when the richest 1% held just over 20% of the pie. Crucially, it also places India among the most unequal countries in the world, surpassing even the likes of Brazil, South Africa, and the United States.

The concentration of wealth at the top has become so extreme that just 10,000 Indians now have an average annual income of a staggering 480 million rupees ($5.7 million) – more than 2,000 times the national average of 200,000 rupees ($2,400). This stark contrast highlights the stark reality that for the vast majority of Indians, the country’s economic growth has done little to improve their standard of living.

The shrinking middle class

As the billionaire class continues to amass wealth at a breakneck pace, the middle 40% of Indians have borne the brunt of the country’s growing inequality. Their share of the national income has plummeted from over 45% in the early 1980s to a mere 27% today.

This alarming trend has significant implications for the aspirations and social mobility of the Indian middle class. The researchers behind the World Inequality Lab study note that the “only opportunity for transformation for anyone in the middle class is to play a lottery and get into one of these very few institutions that can propel you to a white-collar job.” In other words, the prospects of relative upward mobility have slowed to a crawl, as the traditional pathways to the middle class have become increasingly inaccessible.

The stagnation of the middle class is further exacerbated by the Modi government’s policy decisions, which have disproportionately impacted the informal sector and small businesses. Measures like demonetization, the introduction of the Goods and Services Tax (GST), and the COVID-19 lockdowns have all dealt a devastating blow to the livelihoods of millions of Indians, with the middle class bearing the brunt of these “policy shocks.”

Taxing the middle: A cure-all solution

In a move that has left many up in arms, the recent Union Budget introduced a raft of tax hikes that target the middle class, including a higher surcharge on income tax, higher short-term and long-term capital gain taxes, the loss of indexation on real estate, and a new levy on high-value insurance policies. Meanwhile, the government has continued to offer generous tax breaks and incentives to the country’s wealthiest individuals and corporations, perhaps in the belief that trickle-down economics work.

This curious approach has led to widespread criticism, with opposition parties and economists alike lambasting the government for its apparent disregard for the plight of the middle class. “The common man is far away from the dark reality,” laments renowned economist Jayati Ghosh, “while the regime is obsessed with narratives.”

The irony is not lost on many. As the income and wealth of the top 1% continue to soar, the very segment of society that the BJP once promised to uplift now finds itself saddled with an ever-increasing tax burden, further eroding their already-strained purchasing power.

The hollowing out of India’s middle class

The shrinking share of national income held by the middle 40% of Indians is not just a statistical anomaly – it reflects a deeper hollowing out of the country’s middle class. As the wealth and income of the elite have surged, the middle class has found itself increasingly squeezed, struggling to maintain their standard of living and fulfill their aspirational dreams.

The data paints a stark picture. While the richest 10% of Indians now control a staggering 60% of the national income, the bottom 50% have seen their share dwindle to a mere 15%. This concentration of wealth at the top has had a ripple effect, with the middle class finding it increasingly difficult to access the very goods and services that were once within their reach.

The implications of this hollowing out are far-reaching, not just for the middle class itself, but for the broader social fabric of the country. As the pathways to upward mobility become increasingly elusive, the dream of the Indian middle class – of a better life for themselves and their children – appears to be slipping further and further out of reach.

Regressive taxation regimes compound woes, not wealth

The Indian tax system, which was once touted as a tool for promoting social and economic equity, has increasingly become a mechanism for entrenching the country’s inequality woes. According to the World Inequality Lab study, the tax system may be “regressive when viewed from the point of view of net wealth” – meaning that the more wealth a taxpayer owns, the less taxes they pay as a share of their assets.

This troubling trend has been exacerbated by the Modi government’s recent budget proposals, which have introduced a raft of tax hikes targeted at the middle class as it shifts the tax burden onto them, and away from the shoulders of the already-struggling middle class.

The irony is not lost on many. As the billionaire class continues to amass wealth at a breakneck pace, the very people who were once the focus of the BJP’s economic promises now find themselves facing an ever-increasing tax burden, further eroding their purchasing power and social mobility.

This regressive tax regime not only compounds the inequality crisis but also undermines the very foundations of the social contract, as the middle class is forced to bear the brunt of the government’s fiscal policies while the elite enjoy the spoils of their outsized wealth and influence.

Wealth taxes and inheritance taxes: A controversial solution

As the Modi government’s tax policies continue to squeeze the middle class, the mind goes to a bold solution previously proposed by the Communist Party of India (CPI) to tackle the country’s growing inequality: wealth taxes and inheritance taxes.

In its 2024 election manifesto, the CPI had called for the implementation of these measures, arguing that they are essential for keeping the “nature of the economy more equal, just, and egalitarian.” The party’s general secretary, D. Raja, has lambasted the BJP’s rule, which he claims has resulted in “unprecedented concentration of wealth at the top while the poor are pushed to destitution”. The Congress party too proposed a wealth redistribution policy aimed squarely at the super-rich.

The CPI’s proposal for wealth and inheritance taxes is directly opposed to the Modi government’s approach, which has seemingly prioritized the interests of the billionaire class over the well-being of the middle class and the poor. By targeting the vast wealth and intergenerational transfers of the elite, the CPI hoped to level the playing field and create a more equitable distribution of resources.

While the CPI remains a relatively small player in the country’s political landscape, its bold stance on tackling inequality could resonate with a growing segment of the population who have grown weary of the government’s perceived favoritism towards the ultra-wealthy. At the very least, it could spark a much-needed debate on the role of taxation in addressing India’s deeply entrenched inequality crisis.

India’s income divide: A ticking time bomb

The stark reality of India’s inequality crisis is that it is not only morally and socially untenable but also poses a significant threat to the country’s long-term economic stability and growth. As the billionaire class continues to amass wealth at a breakneck pace, the middle class and the poor are being squeezed to the point of desperation, with their purchasing power and social mobility increasingly constrained.

Everything has its breaking point, or tipping point if you will, and if the ground under India’s growth story starts to crumble, it will bring with it social unrest and political upheaval.

The solution, as the researchers behind the World Inequality Lab study suggest, lies in a comprehensive overhaul of the tax system, including the implementation of a “super tax” on billionaires and multimillionaires, as well as a restructuring of the tax schedule to account for both income and wealth. Additionally, the need for a robust investment in education and skills development to create “the right set of human capital” cannot be overstated.

With Haryana, Maharashtra, and Jharkhand poll-bound in the months to come, the question of whether the Modi government’s tax and economic policies will be met with a resounding rejection by the electorate, or whether the opposition will be able to craft a compelling alternative vision, remains to be seen. But one thing is clear: the country’s inequality crisis has reached a critical juncture, and the consequences of inaction could be dire for the very fabric of Indian society.