When the BYD Seal launched in India some months back in the ballpark of ₹50 lakhs, many went ga-ga over it. The top-end Performance spec of the Electric Vehicle (EV) offered staggering features at the price that European carmakers could only dream of, such as a 0-100 Km/h time of 3.8 seconds, real-world range of 500 kilometers, ADAS Level 2, and much more.

At the other end of the sales spectrum, the MG Windsor put the cat among the pigeons in the ₹10-15 lakhs bracket, eroding Tata Motors’ market share 18% Year-on-Year. The Indian carmaker, which sold 4,196 EVs in November 2024, as per Vahan data, faces a sobering future amid this Chinese incursion, which can be borne out by a sobering fact. JSW MG Motor India announced that the Windsor sold 3,144 units in November 2024, a number that stacks up strongly against Tata’s EV portfolio all on its own. And there’s more where that came from.

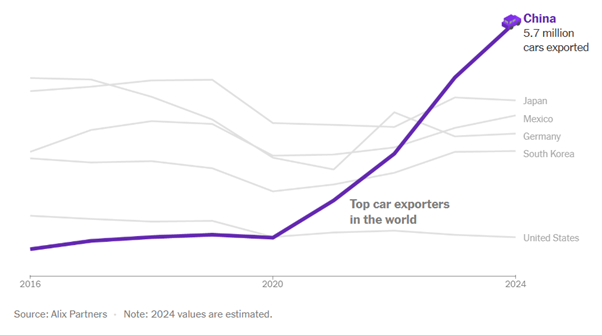

How did this come to pass, when China’s car-making capacity was a fraction of this as little as two decades ago? Simply, the spark for this lay in a shift towards, or emergence of, electric vehicles (EVs). China has been the biggest beneficiary of this switch, as can be seen in its explosive growth post 2020.

In the span of a few years, China has gone from being an afterthought on the world auto map to producing and exporting more cars than any other country in the world.

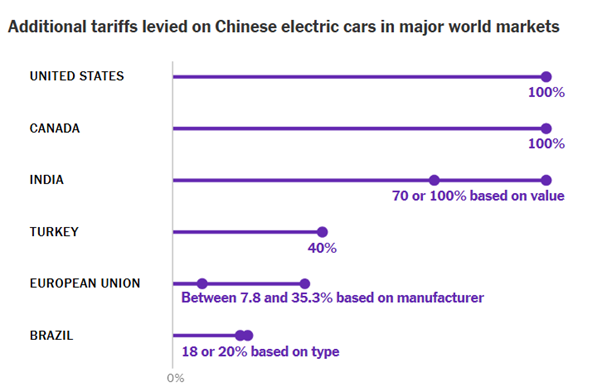

The world has begun to sit up and take note, with the US and EU imposing extra tariffs on China’s electric vehicles, with India no exception to this.

But one cannot stop the inevitable. This move, one suspects, will simply delay it. China’s dominance in automaking (at least in the EV era) is simply too strong, as we will go on to illustrate. Companies such as BYD have mastered the art of rolling out tech-laden EVs at prices that are mouth-watering, like the BYD Seal.

China’s Car-Making Dominance

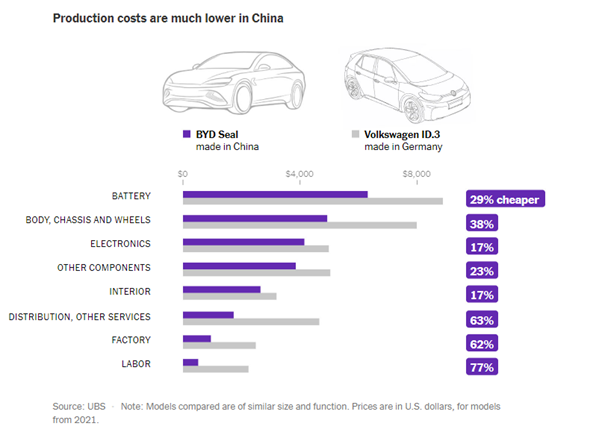

It’s an argument that UBS gives credence to. According to their research, even with these trade barriers in place, BYD has a ~25% cost advantage over established automakers. And UBS expects it to be a Chinese onslaught, with their OEMs potentially doubling their global market share by 2030.

Chinese OEMs’ focus on high vertical integration has paid off richly. In BYD’s case, they simply leverage their efficiencies in cost and scale when it comes to battery cells, vehicle integration, powertrain and electronics modules. European automakers, and indeed global car manufacturers, have a much lower degree of vertical integration.

Chinese OEMs further drive home their advantage by using China as a manufacturing hub, to great effect, which most legacy OEMs can’t fully replicate since they are just JV partners (usually 50% or less), meaning they can’t just set up manufacturing operations in China and closing the gap.

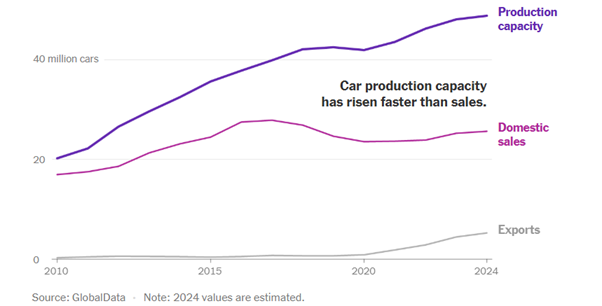

The Chinese market too has grown, nearly as large as the European and American car markets put together. But, fuelled by massive government subsidies and increases in production, its automakers face a challenge on the home front as demand tails off in the wake of an economic downturn. With China today producing twice as many cars as its consumers need, China has increasingly looked overseas to sell cars. And that spells serious trouble for Global automakers.

A Change in the Industrial Model

The auto industry is often seen as a bellwether of the global economy, with its fortunes often correlated to the state of the globe. For Europe, it is closely linked to their history of industrial excellence when it comes to making International Combustion Engine (ICE) shod vehicles. Be it Germany’s traditional car-making firms, Italy’s luxury racers, or even carmakers out of France and elsewhere. The industry directly accounts for four million jobs and 3% of Europe’s GDP.

But the onset of the electric era has seen the ICE age thaw for Europe’s automotive industry complex. No longer are high-performance engines with soaring redlines out of reach. Nor is outstanding vehicle design, a bastion of the Europeans. As the switch to electrification and software-laden cars intensifies, European car makers (and indeed global ones) are facing a reckoning, not least because they are left playing keep-up in battery tech and rapid charging technologies.

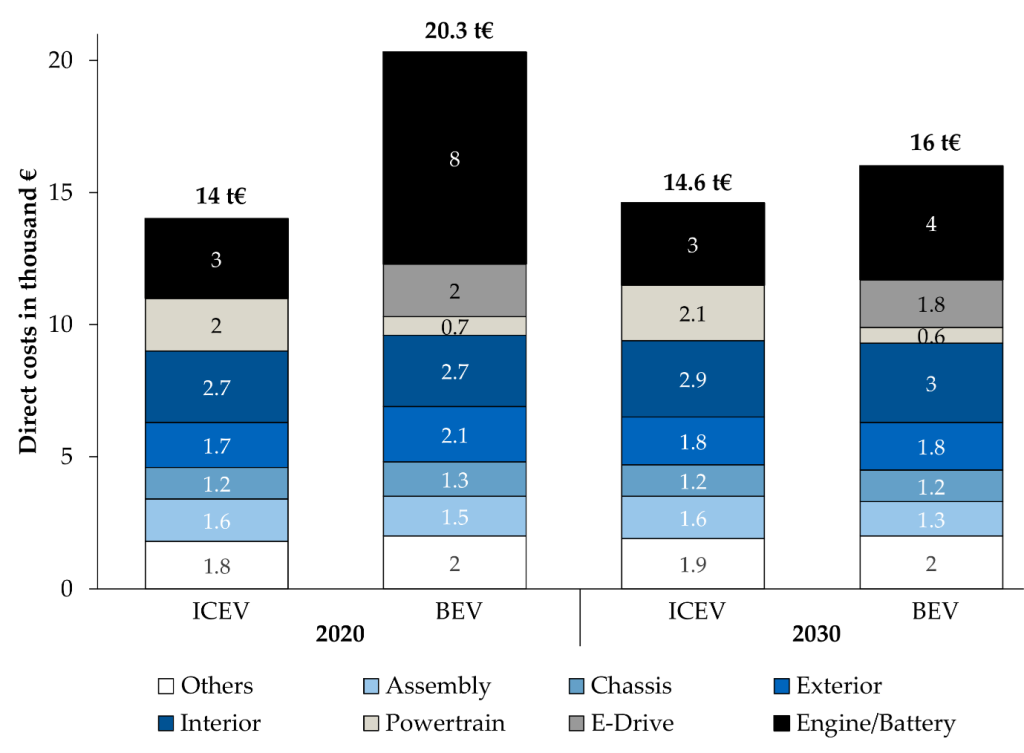

In fact, in a study done by König et al published in the World Electric Vehicle Journal, it was made clear how large the problem is for global automakers. For long, building an engine was the biggest cost in car manufacturing. And building great engines is no easy feat, but it is something Europe and the world perfected over decades. Now, with the advent of EVs, that changes significantly. Battery costs are the biggest component of making such cars (39% of the total cost). No longer does it matter that Chinese carmakers can’t create a great engine. Creating batteries at scale, and low cost, is their biggest strength, and one they are wielding to great effect.

Source: König et al 2021

China too focused on honing its craft over decades. But not on perfecting the car, or just any old car, but specifically the electric vehicle. Today, half of China’s car buyers choose battery electric or plug-in hybrid cars, a trend mirrored the world over.

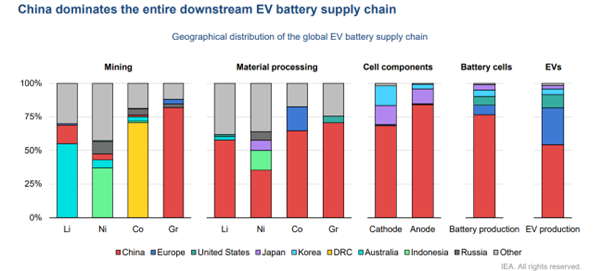

Thanks to Chinese carmakers receiving low-interest-rate loans from state-controlled banks to build dozens of factories, as well as government tax breaks and cheap land and electricity, China dominates the downstream EV supply chain. When it comes to creating the battery cells, its individual components, material processing, and in some cases even its mining, China has a stranglehold on the entire value chain. The result; China dominates EV production, and its why a slew of Chinese automakers are taking Chinese EVs to the world, with more than half of EV production coming out of the Land of the Dragon.

End of the ICE age?

It’s quite clear that all the big guns, such as Volkswagen, who some say have maybe a year or two to turn things around amid financial woes, are in big trouble. Fiat, Chrysler, Citroen, Mercedes, Ford, you name it, and they all know they’re up against it when it comes staring down this Chinese behemoth.

In fact, Ford CEO Jim Farley admitted he has been driving a Xiaomi SU7 for six months and said he “doesn’t want to give it up.” He struck an ominous note for the auto industry, calling Chinese EV makers an “existential threat” that must be heeded.

Indeed, the global auto industry is at something of a crossroads. Myriad factors, such as rising competition and production costs, stringent regulations, challenges in integrating tech, and uncertain global supply chains have all served to make the future path a murky one. A buffet of Chinese manufacturers are doing all they can to eat Global Auto’s lunch, and much has to change if the world must stop China from making this car-shaped cake and eating it too.