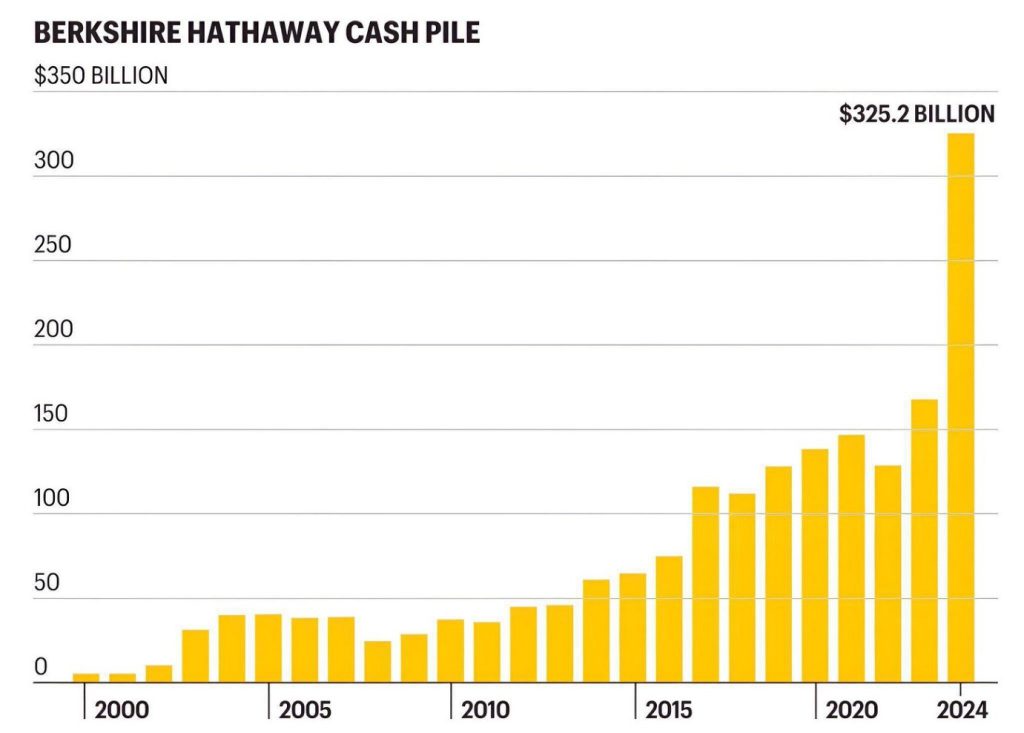

Warren Buffett, the legendary investor and chairman of Berkshire Hathaway, is once again making headlines. This time, it’s not because of a major acquisition or a bold investment move but due to the company’s staggering $325 billion cash reserve—the largest ever held by a public company. This war chest surpasses the combined cash reserves of tech giants Apple, Microsoft, Alphabet, Amazon, and NVIDIA, despite these companies collectively being 14 times Berkshire’s market value.

Why has Buffett, renowned for his investment acumen, opted to hoard cash instead of deploying it into assets? The answer lies in a combination of economic foresight, historical market trends, and Buffett’s well-documented investment philosophy.

Also read: Warren Buffett signals the market about “Big Inflation”

The Art of Patience: Why Buffett is Sitting on Cash

Buffett has often stressed the importance of being “fearful when others are greedy and greedy when others are fearful.” At present, the market appears to be in a state of exuberance, reflected in the S&P 500’s price-to-earnings (P/E) ratio. As of March 11, 2025, this ratio stood at 27.31—well above its historical median of 17.9. Earlier in February, it hit a high of 30.59, a level that has foreshadowed bear markets on four previous occasions.

This indicates that investors are paying significantly more for each dollar of earnings, suggesting stock prices are driven more by optimism than by fundamental value. For a value investor like Buffett, this is a clear signal to exercise caution.

Stock Sales and Market Caution

Berkshire Hathaway has not only refrained from making substantial new investments but has actively trimmed its holdings, including cutting its massive stake in Apple by two-thirds. Over the first nine months of 2024 alone, the company offloaded over $100 billion in equities, reinforcing the view that Buffett sees little value in the current market landscape.

Buffett’s reluctance to buy doesn’t stem from an aversion to spending but rather from an insistence on finding opportunities with low risk and high reward. At Berkshire’s annual meeting in May 2024, Buffett remarked, “We’d love to spend it, but we won’t spend it unless we think we’re doing something that has very little risk and can make us a lot of money.”

Cash as a Strategic Lever

Beyond market timing, Buffett’s cash buildup serves a crucial strategic function: risk management. Historically, Berkshire’s financial discipline has positioned it as a lender of last resort during economic downturns. The 2008 financial crisis serves as a prime example—while others scrambled for liquidity, Berkshire extended capital to firms like Goldman Sachs and Bank of America on highly favorable terms, netting billions in profits.

Buffett has reiterated that this financial strength allows Berkshire to endure and even capitalize on economic turbulence. “Berkshire can handle financial disasters of a magnitude beyond any heretofore experienced,” he told shareholders at the end of 2023. This mindset underscores why Berkshire remains one of the world’s most resilient and financially sound enterprises.

What Comes Next?

Investors and analysts eagerly await Buffett’s annual letter to shareholders for clues on his next move. The company’s annual report will provide a definitive snapshot of its cash position at the end of 2024, offering insights into whether Berkshire intends to deploy capital in the near future.

While market speculation abounds, one thing is clear: with its war chest, Berkshire could acquire nearly any U.S. company outside the biggest corporate titans. Names like Deere, United Parcel Service, and CVS Health are within reach should Buffett decide the time is right. However, until valuations become attractive, he appears content to wait.

The Bottom Line

Warren Buffett’s massive cash reserve is not an indication of inaction but rather a strategic stance grounded in patience, prudence, and historical precedent. By resisting the urge to chase inflated valuations, Buffett is positioning Berkshire Hathaway to strike when opportunities are truly compelling. For investors, his actions serve as a masterclass in disciplined investing—one that may very well pay off handsomely in the years to come.