The IPL has swept away all before it, and (almost all) business loves it, for good reason

18th April 2008 will go down as a red letter day in the annals of cricket. What began as a fledgling T20 competition would grow from strength to strength. Now, in its 15th year, the value of the Indian Premier League (IPL) has soared to an eye-watering $10.9 billion in 2022, according to a report by consulting firm D and P Advisory. This makes it a decacorn, with the value of the IPL ecosystem growing by 75% in dollar terms since 2020, and by 90% in INR terms.

Some of the factors that have contributed to the growth of the league includes the signing of a landmark $6.2 billion media rights deal inked by the Board of Control for Cricket in India (BCCI) in June 2022. This broadcast deal makes IPL the second-biggest sporting league in the world, on a per-match basis, and marked the competition as the fastest-growing sports league globally.

What’s more, the auction of two new teams – Gujarat Titans and Lucknow SuperGiants – for a combined value of $1.6 billion in October 2022 served to only further cement the IPL’s valuation. Other factors, such as an increased number of matches from 74 to 94, newly signed central sponsorship deals, higher ticket sales, and greater in-stadia revenue have also served as flywheels of growth.

The IPL as a consumption driver

Just as it has been for other facets of the business ecosystem, the IPL has been a force for economic growth in all areas of the consumption economy that it has touched. Think of hospitality, sports goods, and even something as obscure as stock prices being affected by the positive sentiment that overflows from a close win the evening before. The positive buoyancy of the IPL is real, and its appeal from a business standpoint is strong. Little wonder that brands from industries as diverse as e-commerce, telecom, FMCG, Edtech, and more have hitched themselves to the IPL bandwagon.

In a nutshell, here are some of the businesses that have made the most of the IPL’s riproaring success.

Here’s a look at the businesses impacted by the cricketing extravaganza.

Hospitality and tourism

With IPL 2022 having been staged largely in Mumbai and Pune, hotels saw a spurt in bookings that are no coincidence. Prices surged by more than 60% on average as demand rose with scant availability.

And it’s not just hotels; these ripple effects positively impacted travel revenues too, with flight tickets seeing an uptick, as did Ola and Uber pricing on the day of the game. Many fans narrated anecdotal experiences of taxis being priced by 20-30% more than usual on match-days.

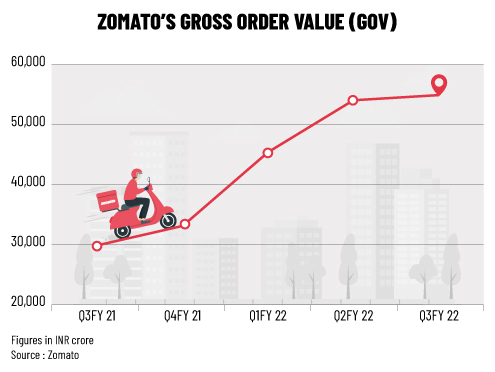

Home delivery services

Of course, while watching a game in person is quite another experience, some choose to eschew this and instead have their own viewing parties at home, armed with enough snacks, food, and drinks to feed a small army. Zomato and Swiggy have been the biggest beneficiaries of this, with their ‘Predict to win’ contests creating a lot of buzz. Expect this trend to continue even as IPL 2023 is expected to be staged in more venues than its predecessor.

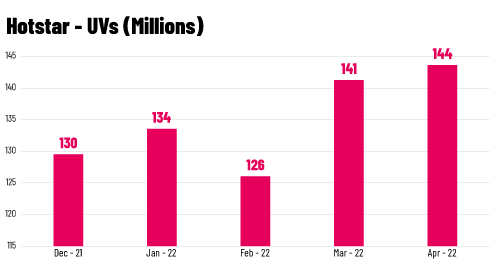

TV & OTT viewership

With the sheer number of eyeballs garnered by the IPL, it is no surprise to see strong advertising demand for this tourney. The 2020 IPL set a viewership record with 31.57 million average impressions, with the tournament recording an average of 4 billion views, which compares favourably with other marquee properties such as the Football World Cup (5.4 billion for Qatar 2022), English Premier League (4.7 billion), and Wimbledon (3.6 billion views).

However, this number tailed off in IPL 2022. The Broadcast Audience Research Council India (BARC) noted that approx. 229 million viewers tuned into the first week of IPL 2022, a smaller number compared to 2021’s audience of approx. 267 million. The reason for this is a change in viewership habits, as OTT exploded, with viewership growing on OTT by over 305% YoY. BARC does not include this as it doesn’t factor in OTT when compiling general TV viewership stats. Thus, the added reach of both TV and OTT options reached around 426 million, still a record by itself.

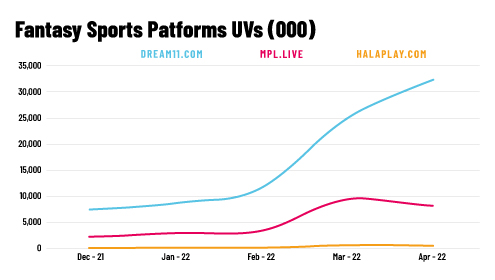

Fantasy sports

In a blog post penned by Visakh Vijayakumar, Sales Director, Comscore, it was noted that the boom in users was seen not only by OTTs, but even by other digital properties, such as fantasy sports platforms and sports news/information websites.

While Dream11 saw Unique Visitors (UVs) grow by 115% from 11.6 million in February 2022 to 25 million in March 2022 to 32 million in April 2022, MPL saw a 183% growth in UVs from February 2022 to March 2022, to reach 9.3 million.

Additionally, the time spent on these platforms also saw a huge jump. Dream11 users spent almost 74 million minutes on the platform in April 2022, a 20% increase from March 2022 numbers of 61.5 million, which in turn was 128% higher than the time spent in February 2022. MPL also saw a 121% growth in times spent from 12.7 million minutes in February 2022 to 29 million minutes in March 2022, he wrote.

Advertisers and Sponsors

Withy an entire nation glued to the IPL, sponsors made sure to put their brand front and center to grab maximum exposure. With advertisers spread across 43 categories, 66 advertisers, and 106 brands, there was a cornucopia of advertisers on show. The stickiness of the IPL is a major draw for them, with a report by consumer-research outfit Red Lab stating that the IPL has an attention index of 142, the highest among cricket and non-cricket media properties.

Both RUPAY.CO.IN and CEAT.COM saw a spike in traffic in March 2022, thanks to their brand names and logos appearing several times on screens and at the stadiums every match, and Swiggy and Cred’s robust and sustained advertising campaigned paid off richly for them.

Drop in footfalls

One of the fallouts of the IPL’s wild popularity is the reduction in footfalls from cinemas, malls, and stores during the few hours that IPL airs. Cinema halls often report a 50% drop in audience numbers, which has caused them to start airing games in theatres too. Retailers too lamented a 20%-30% drop in footfalls at the same time, with reduced conversion rates of 5-15% from these walk-ins, as opposed to 40% of sales usually being closed.

The bottom line

The IPL has been a great catalyst for growth not just in the Indian cricketing sphere, but for business too. It has evolved into this almost self-sustaining machine that churns out entertainment and virtually guaranteed windfalls for sponsors, year after year. Now, with the IPL expected to be played in more stadiums than in 2022, one might expect this cricketing behemoth to be winding up to hit it out of the park in IPL 2023.