Some of the world’s biggest companies are showing how getting ESG right can drive business value

Ever since the term “ESG” (Environmental, Social, and Governance) was coined in 2005, its importance has been growing in the years that passed. Coming to the forefront of the public and corporate consciousness across industries and geographies, today we see a slew of companies allocating more resources toward improving ESG than ever before. Studies show that more than 90% of S&P 500 companies now publish ESG reports in some form, as do approximately 70% of Russell 1000 companies.

As multifaceted risks pop up across the business spectrum, the business case and context for ESG becomes increasingly pressing. Given that ESG impacts are generally long-term in nature, the onus of translating the risks and opportunities inherent to it (such as climate change, resource scarcity, and population growth) fall upon the modern leader.

And in this way, companies are making ESG commitments a core part of their long-term purpose and business strategy, to better manage the business risks and opportunities it will inevitably throw up. Many are even going so far as to create dedicated teams with to make ESG a central growth area for their organizations, with a few leading the way for others to follow.

With the argument for a strong ESG proposition becoming more compelling, let us understand how it can be harnessed to create comprehensive business value.

The ESG value proposition

Through study and research, McKinsey has identified 5 key fronts across which ESG can create undeniable value. These are driving top-line growth, managing costs, minimising regulatory and legal interventions, increasing employee productivity, and optimising investment and capital expenditures. Each of these five levers should be on a leader’s checklist, as well as an understanding of the soft skills needed to know when to apply each of them to do the heaviest lifting needed for any given scenario.

Here’s how each of them can have a role to play in creating business value.

TOP-LINE GROWTH: In an age where consumers gauge brands by how much they’re doing for the planet and society, a strong ESG proposition helps companies tap new markets and expand into existing ones. Similarly, these cues help showcase the brand to governing authorities, creating further growth opportunities. ESG can also drive consumer preference; research has shown that customers say they are willing to pay to “go green”, with more than 70% of consumers surveyed across automobiles, real estate, electronics, and packaging categories, saying they would pay an additional 5% for a green product if it met the same performance standards as a non-green alternative.

COST REDUCTIONS: Executing ESG effectively can help manage operating expenses (such as raw-material costs and the true cost of water or carbon), which can affect operating profits by as much as 60%. In a similar vein, lower energy consumption and reduced water use can lead to cost reductions to differing degrees, depending on the sector a company operates in, and the intensity of the effort made.

REDUCED REGULATORY AND LEGAL INTERVENTIONS: Being seen as proactive and altruistic when it comes to all things ESG can help companies gain strategic inroads and ease regulatory pressure. By giving back to society, companies not only gain favour with consumers, but with governments too. The latter is a significant factor, as studies show that as much as one-third of corporate profits are at risk from state intervention and regulatory changes. Of course, this varies from industry to industry, since pharmaceuticals won’t be as regulated as tech, which decreases the quantum of impact, but doesn’t reduce it entirely.

PRODUCTIVITY IMPROVEMENTS: Employees are increasingly drawn to companies with a clear purpose, and a demonstrably greater commitment to acting on ESG. By giving people a clear direction to pull in and goal to work towards, ESG can help not only boost employee morale and satisfaction, but also shareholder returns. A study by the London Business School’s Alex Edmans found that the companies that made Fortune’s “100 Best Companies to Work For” list generated 2.3% to 3.8% higher stock returns per year than their peers over a greater than 25-year horizon.

Recent studies have also shown that positive social impact correlates with higher job satisfaction, and field experiments suggest that when companies “give back,” employees react with enthusiasm. The opposite is also true, such as a pursuit of profit above all else resulting in greater employee dissatisfaction or worse, manifesting as strikes, slowdowns, or other labour actions. It can at times even manifest beyond the company, such as with external vendors and stakeholders, making this a key lever to keep an eye on.

OPTIMISING INVESTMENTS AND EXPENSES: By switching focus to more sustainable investments, companies can get better returns. This is because medium to long-term perspectives are changing on environmental issues, and organisations would do well not to sink investments into causes that won’t have a strong standing in society and industry over the long-term.

Bear in mind that while the investment needed to update the organisation might be a significant one, inaction could prove to be even more damaging. Regulatory concerns are bound to heighten, with countries committing to curbing emissions, industries looking to rein in energy costs or switch energy sources entirely, and this could greatly impact industries that are either carbonintensive or have green alternatives available. Therefore, companies must repurpose assets or restructure as needed to get ahead of the curve, making the most of the tailwinds that exist.

Companies leading the way

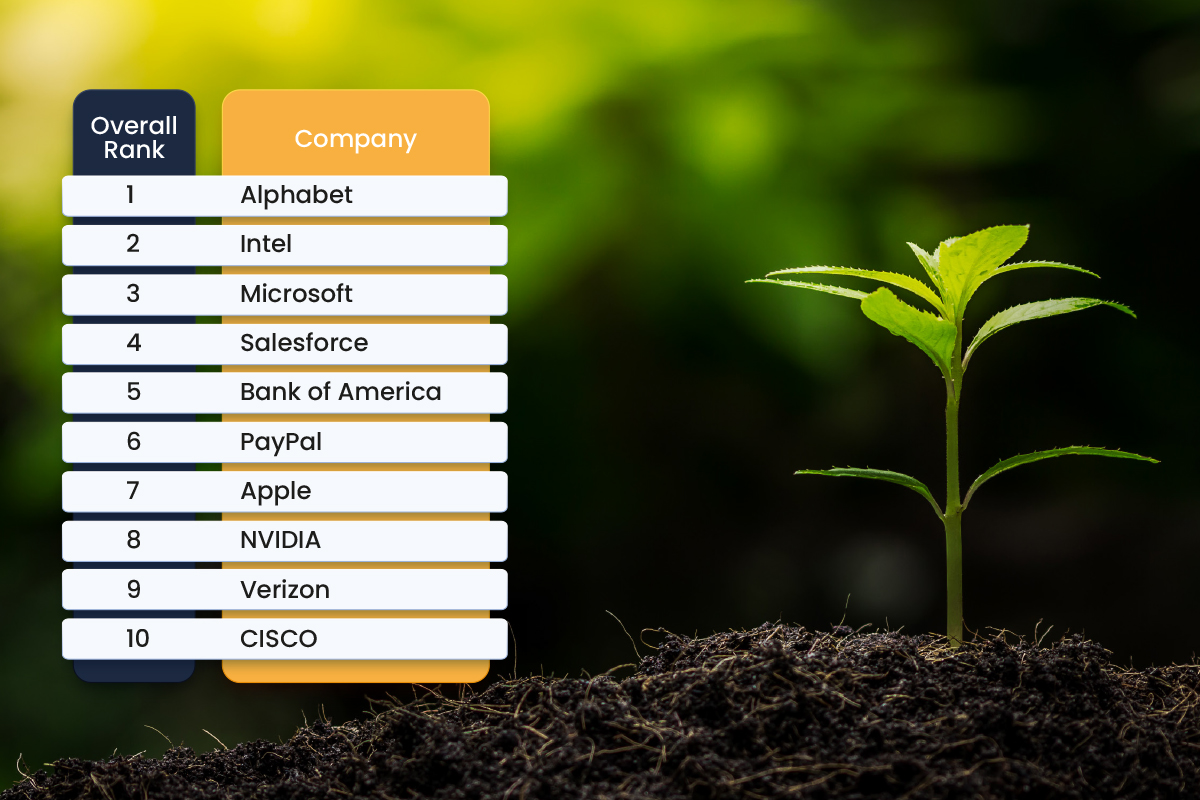

Stakeholder capitalism has increasingly become a focus area for businesses, coaxing them to do better for all. And as they strive to do so, research and investment firm JUST Capital released a ranking of the 100 top performing ESG firms across industries, which paints a clear perspective of the state of how ESG is supporting the business and investor case for some of the world’s most notable firms.

Notably, the weightages given by JUST to each parameter is based on ongoing surveys, and so it is telling to see the importance placed on treating employees well. This has been a hot button topic for the past few years, so it is not surprising to see it emerge as a key topic of importance on the ESG front as well.

How does the ranking work?

The ranking looks at issues critical to stakeholders, from their workers and shareholders to customers, communities and the environment. In summary, the parameters looked at include:

WORKERS: How a company invests in its employees (40 percent weighting).

COMMUNITIES: How a company supports its communities (20 percent weighting).

SHAREHOLDERS AND GOVERNANCE: How a company prioritizes good governance (19 percent weighting).

CUSTOMERS: How a company treats its customers in areas such as data privacy (11 percent ranking).

ENVIRONMENT: How a company minimizes its environmental impact (10 percent).

What inferences can we make from these rankings?

For one, it must be said that the names on this list aren’t the 10 best performing companies by conventional metrics (such as revenue, CAGR, and so on). But even so, it must be noted that 7 of these firms saw their stock value increase year-on-year. According to JUST, the Top 100 overall companies in the JUST 100 earn nearly 4.5% more, and pay 19% more in dividends than the rest of the Russell 1000. So it does pay to invest in ESG measures.

More than anything though, the study helps measure how much corporations have actually moved the needle on sustainability, a simple separation of intent and words from execution. Businesses today have a trust deficit, and acting on ESG is a nearly sure-fire to win hearts and the marketplace. But equally important is showing demonstrable, quantifiable ESG measures, as everyone will definitely talk about going green, but few will walk the talk. The imperative for companies to earn their social license appears to be increasing, and with it the business case for ESG. The time for companies to unlock value with it is now.

“Earth provides enough to satisfy every man’s need, but not every man’s greed.”

“Climate change is destroying our path to sustainability. Ours is a world of looming challenges and increasingly limited resources. Sustainable development offers the best chance to adjust our course.”

“Fiscal policy should balance growth, equity, and sustainability concerns, including protecting society’s most vulnerable.”

“We simply must do everything we can in our power to slow down global warming before it is too late. We can save our planet and also boost our economy at the same time.”

“We only get one planet. Humankind must become accountable on a massive scale for the wanton destruction of our collective home. Protecting our future on this planet depends on the conscious evolution of our species. This is the most urgent of times, and the most urgent of messages.”

“It is critical for us to cultivate consciousness and compassion towards our environment, create awareness, galvanize people, and build sustainable innovations for sustainable development. I think good work, sincerity and discipline speak for themselves.”

“Nobody understands how the world will change. The only way you can plan for the future is to have scenarios. You have to have the courage to take a leap of faith on one of them.”