Amid global uncertainties and innumerable crises, India is a bright spot on the global growth map. The challenge will be to sustain this positive momentum over the coming decade

Words by Karan Karayi

One cannot help, but be swept away in a wave of optimism when speaking about India’s medium to long-term growth prospects. A glut of numbers are thrown at you to drive home this point; that India is on track to become the world’s third-largest economy by 2027, surpassing Japan and Germany. That its stock market will become the third-largest as well by 2030, thanks to global trends and key investments the country has made in technology and energy. And that India’s GDP could more than double from $3.5 trillion today to surpass a staggering figure of $7.5 trillion by 2031.

This general atmosphere of positivity is well-founded, given the investment incentives and corporate tax cuts on offer for corporates, and infrastructure spending that has happened and in the offing to help drive capital investments in manufacturing. These are targeted measures aimed to boost India’s share of global manufacturing, catalyse entrepreneurship, and spark consumer spending.

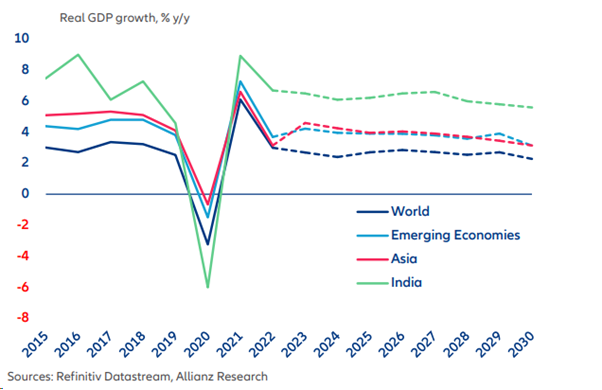

And it seems to be working too. Over the course of the past decade, India is the fastest-growing economy in the world, having clocked 5.5% average gross domestic product growth. With growth opportunities few and far between the world over, it is little wonder that India is a bright spot on the radar of global investors.

But for those that are quick to hail India’s ascension, caution is in order, alongside addressing the dragon in the room.

India is not the New China

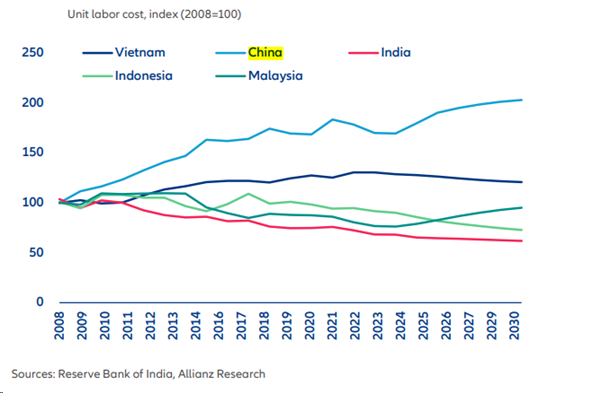

Without a doubt, India has multiple advantages when weighed against its neighbours and the global economy. Its burgeoning talent pool and lower unit labour costs make it a prime choice for businesses looking to re-shore operations.

At a policy level too, economic reforms such as the Production Linked Incentive scheme serve as a strong reason for India to be the “Plus One” in any China Plus One strategy. Through knowledge building, improved efficiency, and heightened innovation, India’s manufacturing sector can be taken to further heights.

But while the future is bright, the present cannot be ignored, even if China’s growth engine seems to be misfiring for now. Here’s why:

- In 2023, China’s GDP was 4.74 times greater than Indias. On a PPP basis, the gulf isn’t as large, but it’s still 2.51x of India.

- China currently accounts for 30% of the total global value added from manufacturers. Conversely, India’s manufactures account for only 3% of the total global value added. That’s before considering India is reliant on China for essential imports like semiconductors.

- If you move away from industrial sectors, and into innovation, one can point out that India witnessed a growth of 25.2% in patent applications year-on-year, with a total of 77,068 patent applications filed in India in 2022 (38,551 by Indian residents and 38,517 by non-residents). The Chinese have been even busier though; their Patent Office received 1.6 million applications in 2022.

- Some structural labour differences stymie India. For instance, China’s female labour force participation rate is almost three times higher than India’s. Further, low literacy rates limit the number of job-seekers available for vocational work in India, especially in the manufacturing sector.

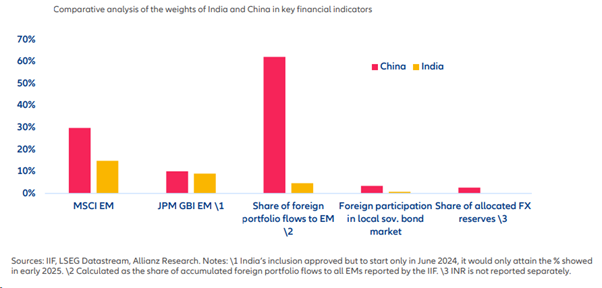

That’s before you get to perhaps the most important metric of all; China’s financial market is much larger and better developed than India’s, thanks to the growing financial strength of China, and the strengthening of the Yen.

But then, India need not necessarily replace China as the world’s manufacturing hub. There are some structural differences between the economies, and India can follow a unique path to a high-growth trajectory.

One piece of the puzzle is already in place, with India driving the development of world-class digital infrastructure to drive growth. But equally, there is a need for physical infrastructure to mirror it, with the private and public sectors equally working towards developing this aspect.

Ultimately, India’s ability to maximise its demographic dividend will be critical, making upskilling the workforce vital to meet the demands of a new era vital to national competitiveness. This, coupled with addressing key facets such as improving currency convertibility, reducing regulatory red-tape, and boosting FDIs will be vital for ensuring India’s sustained growth and success. Other financial hubs such as Singapore, Hong Kong, Shanghai, and the UAE are equally eager for a slice of the pie, and are better placed than India when it comes to infrastructure, regulatory environment and market access.

Suffice to say China is not the growth target, but it need not be, as economic events since 2021 have shown.

The Decade Ahead

While all the talk has centered around India growing into a $5 trillion economy by 2027, some are predicting that this could even touch $10 trillion by 2030. On the back of some megatrends – namely a shifting of operations to India, a surge in digitalisation, and a transition to renewable energy – are setting the scene for unprecedented economic growth.

Let’s look at some broad trends for India in the decade ahead.

GDP Growth to Remain Strong Despite Headwinds

India emerged from the pandemic in rude health, posting GDP growth figures of 7.2% in FY 2023 (ended March 2023), which may cool to 6% in FY 2024 due to a global slowdown and inflationary effects from the world over, as per S&P Global. Even with that ballast, India will be the fastest-growing economy in the G20, outperforming its peers comfortably, and it will likely be so well until 2030

S&P expects India to grow at 6.7% per year from fiscal 2024 to fiscal 2031, with Per Capita GDP expected to rise to about $4,500. All good signs, as you’d surely agree.

Manufacturing’s Share of GDP will likely increase

India is also poised to become the factory to the world, as corporate tax cuts, investment incentives and infrastructure spending help drive capital investments in manufacturing.

Consistent efforts to create a conducive atmosphere for manufacturing seem to have paid off, with fortuitous circumstances coupled with concerted government efforts to

invest in infrastructure as well as supplying land for building factories. This is expected to spur manufacturing’s share of GDP in India from 15.6% currently to 21% by 2031, leading to a potential doubling of India’s export market share.

The continued creation of jobs in the manufacturing sector will be vital to this cause, as will a shift away from agriculture to the manufacturing and services sector if we are to make the vast of our vast talent pool.

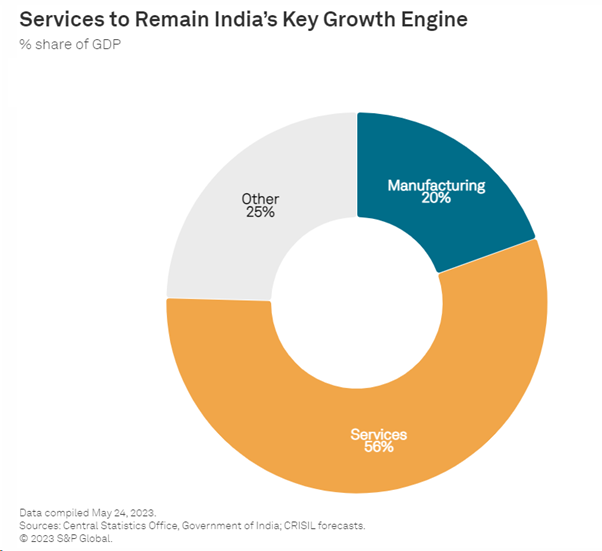

Services to Remain an Engine of Growth

The rise of manufacturing notwithstanding, services will remain India’s export growth engine. The sector’s share of total exports has already risen to 42% in fiscal 2023 from about 30% in fiscal 2012. This trend will likely continue, with the government’s latest trade policy (2023) setting a target to boost overall exports to $2 trillion by 2030.

The growth of the services sector can have some unintended upsides, as can be seen in the case of Global Capability Centers (GCCs). India is now home to the largest share of GCCs globally, and they have now taken on a life of their own beyond their originally intended function, where they now contribute greater value across R&D, design,

auditing, and more for their parent companies.

Nevertheless, the key to the sector’s success will be to ensure ample employment opportunities and high productivity levels across the board if it is to scale new heights.

India’s Transition to a Clean, Green Energy Machine

India is home to some of the most polluted cities in the world, and with absolute and pre capita emissions trending upwards across the nation, the urgent need of the hour is to reverse this trend on a war footing.

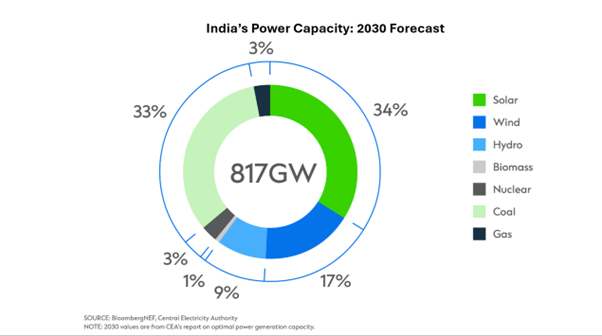

This brings to light the need to catalyse India’s energy transition, with the country setting itself a target of producing 500 GW of renewable energy capacity by 2030, which it expects to achieve well before then.

Decoupling India’s economic growth from greenhouse gas emissions is a massive, urgent project that will call for collective action on the part of public and private players. Getting it right could create a virtuous cycle of growth that generates more jobs and investments for future growth, and major players are doing their bit to make this a reality. Last year, Adani Group announced a strategic partnership with Total Energies to jointly create the world’s largest green hydrogen ecosystem with an ambitious investment target of $50 billion over the next 10 years in green hydrogen and associated ecosystems. Other major leading Indian companies aren’t far behind in taking action, including Reliance, TATA, JSW Energy, and NTPC Limited.

Looking to the Future

India stands at an exciting point in its journey, becoming an influential voice in shaping the global narrative, driven in no small part by being on track to become the world’s third-largest economy by 2030.

But what has got us here will not necessarily take us to the promised land. If this vision is to be realised, India must pivot from being a primarily agrarian society to an economy underpinned by robust services, advanced manufacturing, and knowledge-creation.

India’s sprawling populace is as great a growth multiplier as it is a challenge. PM Modi has grand plans for India, but it can only be realised if we harness our collective creative energies to bring those dreams to fruition. It is in the world’s interests that India does, acting as a beacon of inclusive, sustainable economic growth.