Realising the vision of a net-zero world calls for profound economic and societal shifts, upending established paradigms as new opportunities emerge

Over the course of some 10,000 years of human existence and evolution, humanity has pursued many an objective with tireless zeal, all in the name of progress. But the very progress we have realised now threatens the very existence of future generations as the effects of global warming and climate change start to take hold. All of us are feeling the heat, figuratively or otherwise, and the socioeconomic ramifications of this will be massive as well.

The Great Net-Zero Transition

As the true urgency of the climate challenge before us dawns on us all, investors, customers, and regulators are looking to industries to reduce their net emissions of Greenhouse Gases (GHGs) to zero, with clear roadmaps for the achievement of these objectives. This is clearly a movement with a lot of momentum behind it; nearly 90% of emissions are now targeted for reduction under net-zero commitments, and financial institutions responsible for more than $130 trillion of capital have declared that they will manage these assets in ways intended to hold warming below 1.5°C.

A transition of this scale to consciously choose projects that emit minimal GHGs may lead to the largest reallocation of capital in history take place, with estimates projecting an increase in spending in the range of $1 trillion to $3.5 trillion more per year than today for renewable energy, circular materials, and other low-emissions inputs. At present, about 65% of annual capital spending goes into high-emissions assets. But in a scenario where the world reaches net zero in 2050, McKinsey analysis suggests that this pattern would reverse; 70% of capital outlays through 2050 would be spent instead on low emissions assets.

A transition of this scale to consciously choose projects that emit minimal GHGs may lead to the largest reallocation of capital in history take place, with estimates projecting an increase in spending in the range of $1 trillion to $3.5 trillion more per year than today for renewable energy, circular materials, and other low-emissions inputs. At present, about 65% of annual capital spending goes into high-emissions assets. But in a scenario where the world reaches net zero in 2050, McKinsey analysis suggests that this pattern would reverse; 70% of capital outlays through 2050 would be spent instead on low emissions assets.

Of course, a pivot of this nature cannot be undertaken without complete consumer support, which is a critical lever. But assuming that consumer demand does drive this change, the proactive pursuit of net-zero opportunities could well define tomorrow’s outcomes and differentiate tomorrow’s leaders.

A Change of the playing field

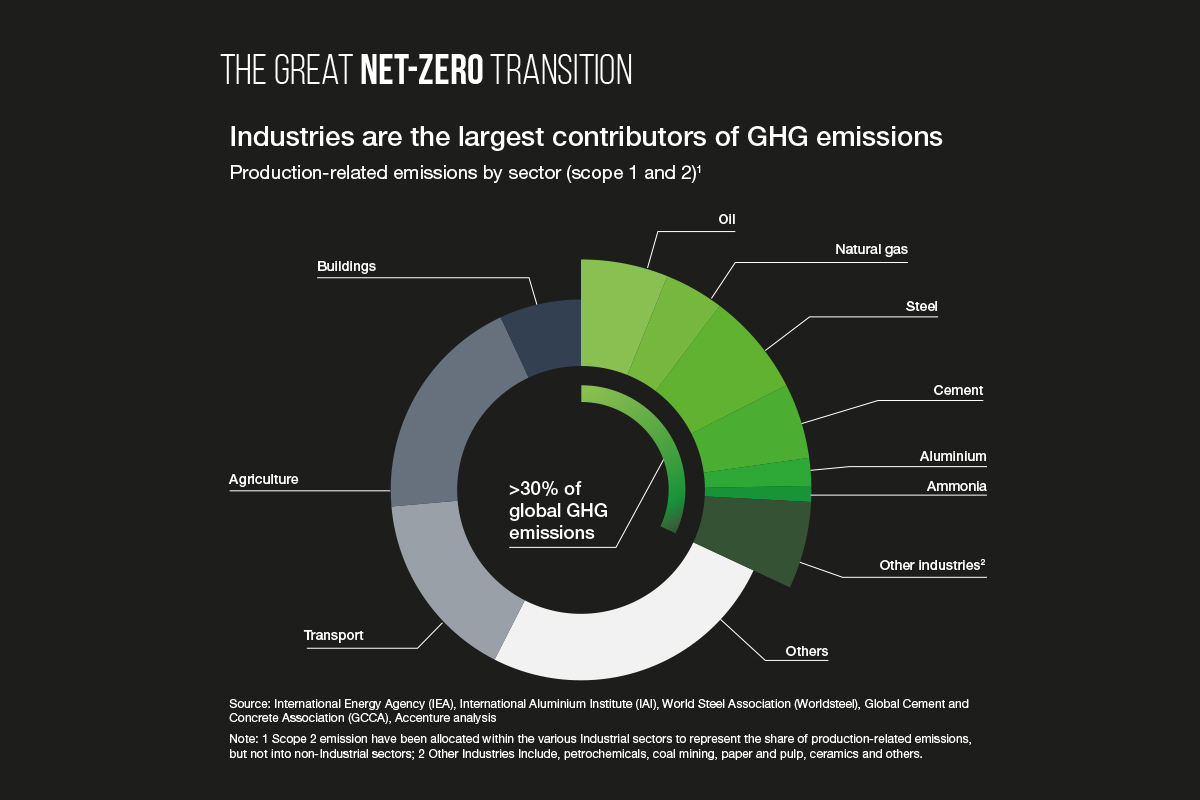

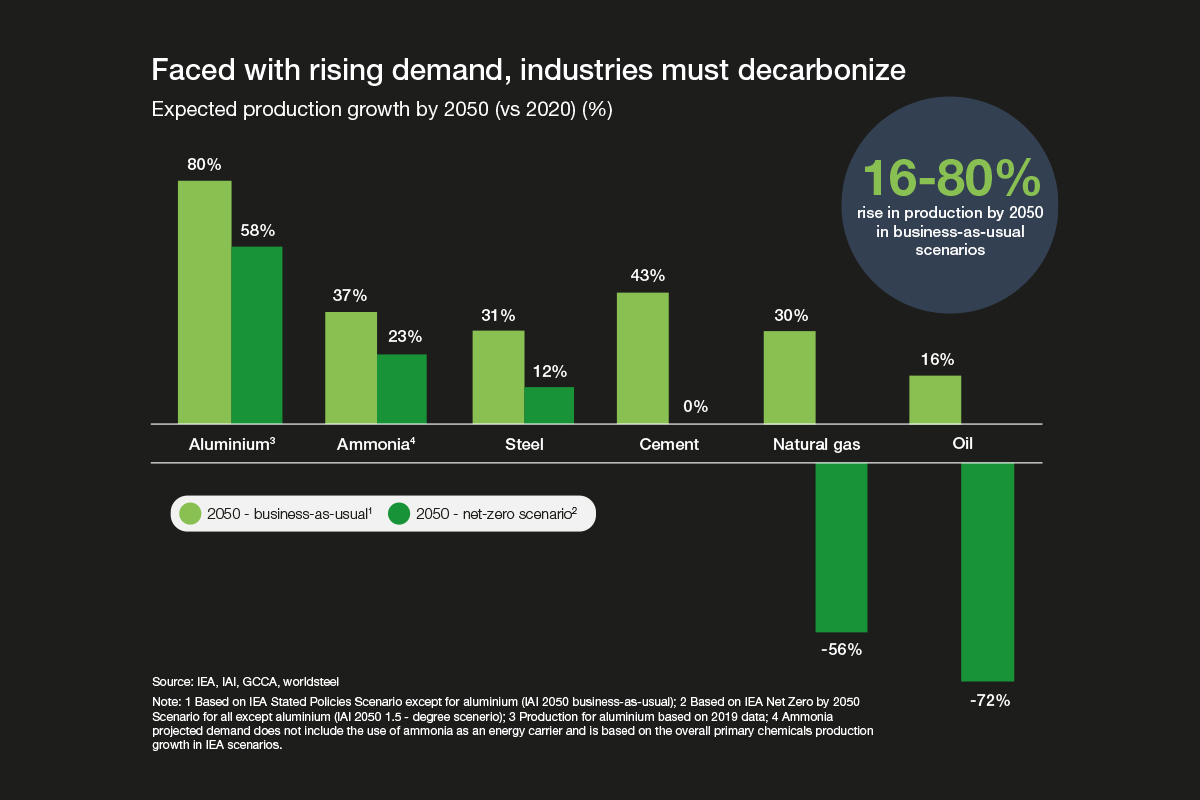

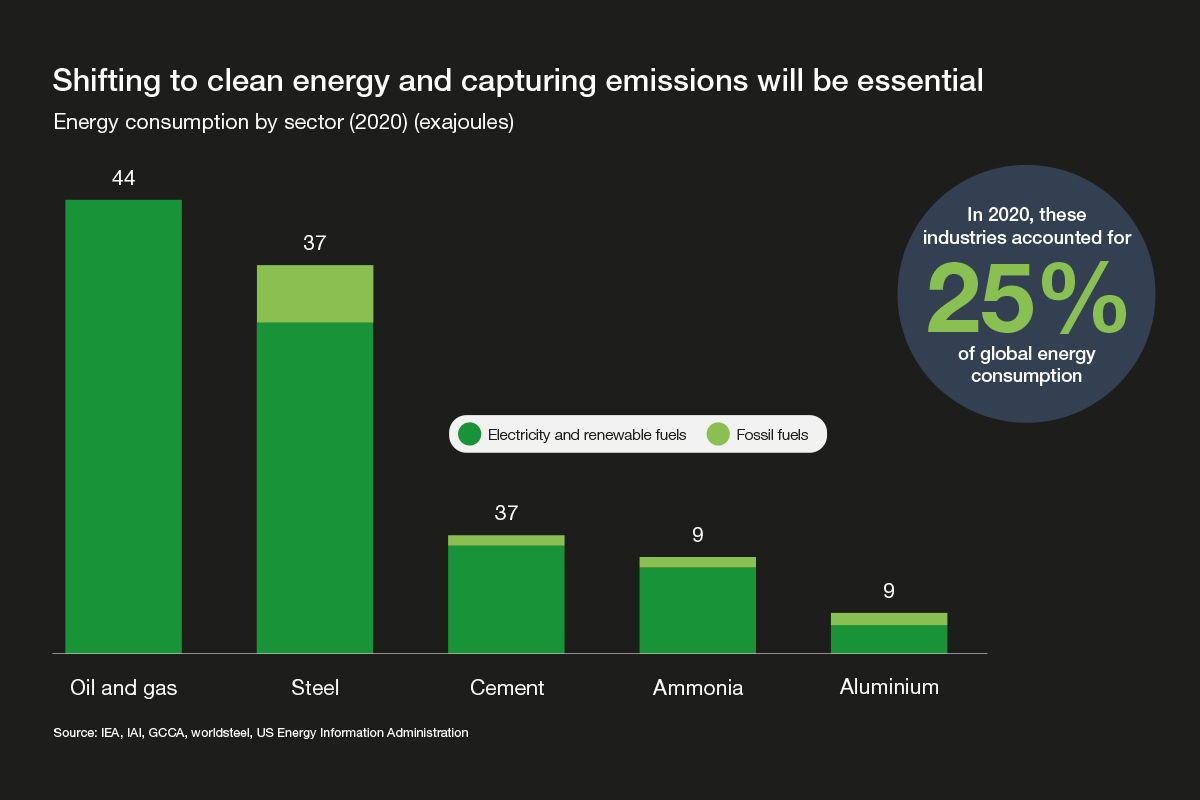

Net-zero signifies a seminal moment in human history, denoting a fundamental transformation in the way we see some of the building blocks of the world economy related to emissions, such as energy, industry, mobility, buildings, agriculture, forestry and other land use, and waste. Of these, industry accounts for almost 40% of global energy consumption and more than 30% of global greenhouse gas emissions, so its decarbonization is essential to break the cycle of noxious emissions and go green.

As a major source of global emissions, retooling the energy sector will be pivotal to achieving the objectives of net-zero. However, this is easier said than done. Multiple efforts by governments to tackle the cause of global warming have been instituted, but CO2 emissions from energy and industry have increased by 60% since the UN Framework Convention on Climate Change was signed in 1992. Achieving net-zero emissions by 2050 will require nothing less than a mass transformation of the global energy system.

Switching to Renewable Energy sources, such as solar and wind, will be essential to reducing emissions in the electricity sector, which is currently the single largest source of CO2 emissions. In fact, the World Economic Forum estimates that for the vision of net-zero to be realised, a majority (almost 90%) of global electricity generation in 2050 must come from renewable sources. Creating energy efficient solutions for mobility, buildings, home appliances, and industry thus becomes an opportunity, creating employment and growth opportunities aplenty in the process.

Time to be Proactive

For too long, organisations have tackled the prospect of sustainability and net-zero targets by following a reactive playbook that ringfences cash flows from regulatory and shareholder or stakeholder mandates. Now, the time has come to meet the challenge head-on and be proactive as changing consumer sentiments potentially preface surging demand for climate friendly goods and services and the sustainable energy, equipment, and infrastructure needed to produce them

Leaders and first-movers that pick up this gauntlet and make moves in spaces that aren’t populated as of now by making the most of low-cost green financing. This includes building carbon-free production capacity, or creating capacities to meet the needs for scarce commodities such as green steel or recycled plastics. This new world order that we find ourselves in needs new rules to be followed, and these see a clutch of new possibilities emerge for value creation across industries, such as recycled plastics, meat substitutes, sustainable construction materials, chemicals, and much more.

Certain green products and services are also proving to be more lucrative than their legacy counterparts, and savvy companies are capitalizing on this by adjusting their business portfolios to cater to high-growth segments, some of which they might not currently even be present in. While risks will always abound, the upsides are enormous and too large to ignore, regardless of whether you view it from the perspective of profit or purpose. It is no doubt a challenging remit, but there has been no hurdle so large that the human spirit has not been able to surmount in the last 10,000 years. But none of those actions are as important as the ones we must take in the next decade. The time for action is now.

Every year, our consumption rate is taking more out of the Earth than we can sustainably expect the planet to generate. We don’t have to be scientists to understand that we are on the road to catastrophic disaster. It’s like we’re headed to the edge of a cliff, and risk going over, but instead of hitting the brake, we are hitting the accelerator. Insane as it is, billions all over the world are doing exactly that. This grave situation needs everyone to take notice of it, and to act urgently.

Vivek Bhatia

MD & CEO

thyssenkrupp Industries India

“Sustainability has been around for a while, even if we may not have been part of that conversation. We have just woken up to it very recently. Over the past 2-3 years, it has acquired a new name; ESG. The topic of sustainability and ESG is a very holistic, interconnected one, and the issues that they deal with are critical to ensure organisational resilience going forward.”

Anirban Ghosh

Chief Sustainability Officer

Mahindra Group