With the global economy deeply interconnected despite protectionary measures being put in place, how will China’s deflationary pressures impact the world?

Words by Karan Karayi

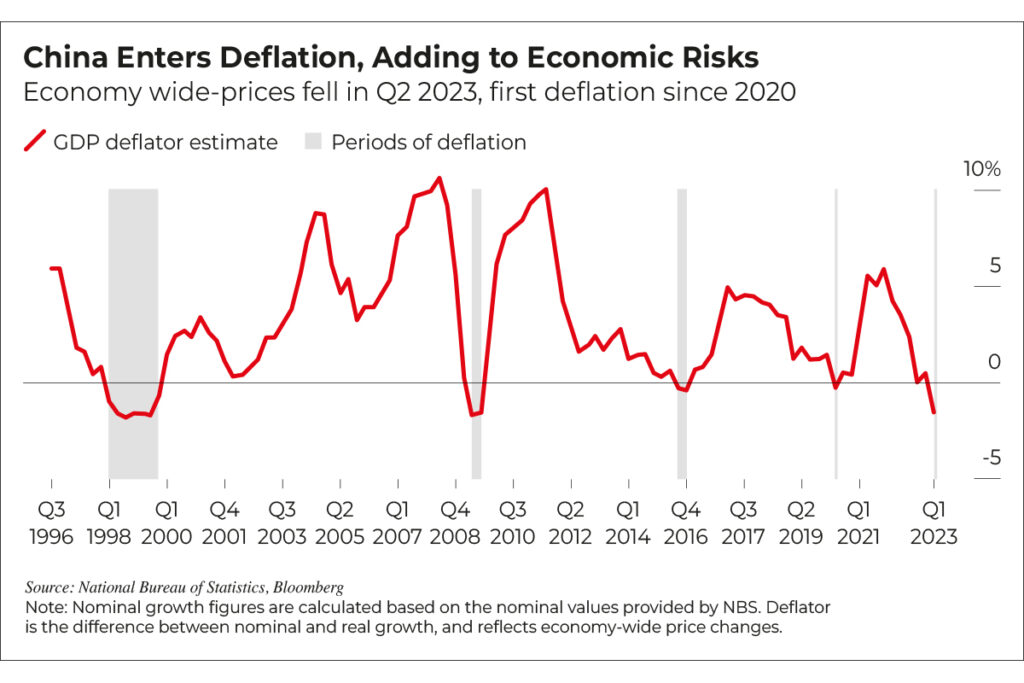

While many countries, including the UK and Europe, are experiencing high inflation rates, Chinese officials at the helm of the world’s second-largest economy are currently grappling with an opposite problem that is equally worrisome – deflation. Consumer prices have dipped by 0.3% compared to the previous year, and just slightly better than median estimates for a 0.4% decrease. Producer prices have fallen for ten consecutive months, contracting by 4.4%.

This is not an unfamiliar situation for China, which has found itself in a similar situation in late 2020. These developments have raised concerns about China’s growth prospects and have prompted analysts to draw parallels with Japan’s deflationary era in the 1990s.

Underlying Causes of China’s Deflation

A combination of factors has contributed to China’s descent into deflation. One significant factor is the ongoing property slump, which has eroded consumer and investor confidence and curtailed spending. Troubles in the shadow banking industry have also dampened consumption and investment. Additionally, China’s exports have experienced a decline, partly driven by geopolitical tensions and the war in Ukraine, which has led to a rise in commodity prices, including oil. These circumstances have come together to create an environment conducive to deflationary pressures.

Implications for the Global Economy

China’s deflationary challenges have far-reaching implications for the global economy. On the one hand, falling prices in the world’s factory are likely to translate into lower costs globally, benefiting consumers and businesses alike. The prospect of slower global price pressures could relieve central banks from the need for further interest rate hikes and potentially pave the way for easing measures to stimulate slowing growth. However, a weak Chinese economy and deflationary environment could also lead to a slowdown in Asia and Europe, impacting these regions’ economies.

Impact on the USA and Europe

While high inflation has been a concern in many countries since the pandemic, China’s deflation presents a different scenario. The United States, in particular, has witnessed quickened inflation rates in recent years, reducing consumers’ purchasing power and necessitating interest rate hikes by the Federal Reserve. However, China’s deflation is distinct due to its unique circumstances, including the prolonged property slump and troubles in the shadow banking industry.

Consequently, the impact on the USA and other trading partners may be minor and transitory. Moreover, the US’ reduced purchases of Chinese goods and the war in Ukraine driving up commodity prices, such as oil, could mitigate the effects of Chinese deflation on the global stage.

Response of the Chinese Government

As China grapples with deflation, its government has acknowledged the challenges and pledged to roll out a stimulus package to address the economic downturn. However, analysts note that more significant measures akin to those implemented in response to the 1998 deflationary period may be necessary to revive the economy effectively. These measures could involve recapitalizing underperforming banks and downsizing the state sector, as was done before China joined the World Trade Organization. While Beijing has taken some steps to stimulate the economy, such as reducing interest rates, it is yet to implement substantial measures that could trigger a revival.

Outlook for GDP Growth and Housing Market

The lack of substantial stimulus measures has led economists to revise their expectations for China’s GDP growth this year, bringing it closer to the country’s official target of around five percent. However, some analysts believe that this target may be at risk due to a faster-than-expected drop in exports and a weakening housing market. Home prices in China have been falling since last year, marking the first decline since 2015. The slowdown in the housing market, combined with factors like a slower post-lockdown recovery and high youth unemployment, has raised concerns about the potential impact of deflation on consumer spending and the burden of debt.

Reversing Deflationary Trends

To reverse the deflationary trends in China, policymakers may need to adopt a comprehensive approach. Accelerating government spending, raising government debt, and implementing coordinated monetary and fiscal easing measures could help break the debt deflation trap. Additionally, targeted stimulus measures aimed at addressing the housing market, financial imbalances, and ageing demographics are crucial to restoring economic growth.

By cutting red tape and implementing consumer-friendly regulations, the Chinese government can create an environment conducive to increased confidence and spending. Furthermore, interest rate cuts and increased central-government spending, particularly in green infrastructure and flood prevention, could boost demand and help China adapt to a changing economic landscape.

China’s descent into deflation poses challenges for its economy and the global stage. While the global economy may benefit from lower costs due to falling prices in China, the potential slowdown in Asia and Europe could have broader implications. The response of the Chinese government, including the implementation of necessary stimulus measures, will be crucial in reversing deflationary trends. By addressing the many elephants (or dragons) in the room, such as the housing market, financial imbalances, and ageing demographics, China can lay the groundwork for a revival. Ultimately, a coordinated approach involving both monetary and fiscal measures is required to break the debt deflation trap and restore sustainable economic growth in China.