In a short seller’s bombshell allegations lies a sobering reminder for India’s policymakers and Big Business

It was a battle of biblical proportions, as David took on Goliath, albeit in the corporate arena. And history repeated itself, as a giant was felled by an unheralded opponent in one fell swoop.

The bigger they are, the harder they fall. Who knew that Hindenburg Research’s claims, laid out in an explosive near-100 page document backed by forensic research, would waylay the group of companies owned by a man who was then Asia’s richest person? The New York based short-seller questioned the Adani Group’s finances, calling it the “largest con in corporate history”, to which Adani countered that the charges are baseless.

But the fallout of the questions raised about the Adani Group’s finances have been far-reaching. Investors were spooked, leading to $100bn in market value going up in smoke, in addition to tens of billions being erased from the tycoon’s personal wealth. The Group’s US dollar bonds also saw a steep slide, while the Group’s follow-on public offer (FPO) was withdrawn. This leaves the Group short of INR20,000 crore needed for funding capex plans across development of green-energy assets, airports, and roads.

The road ahead

From ports to mines, media to energy and much more, the conglomerates diverse offerings are deeply embedded in the Indian way of life, and the ripple effects of these shockwaves will doubtlessly impact millions of Indians. It was among India’s top ten biggest non-financial firms, by assets, and had been projected to grow rapidly, but this stark turn of events puts at least a few question marks over how the Group will fuel its projected investments.

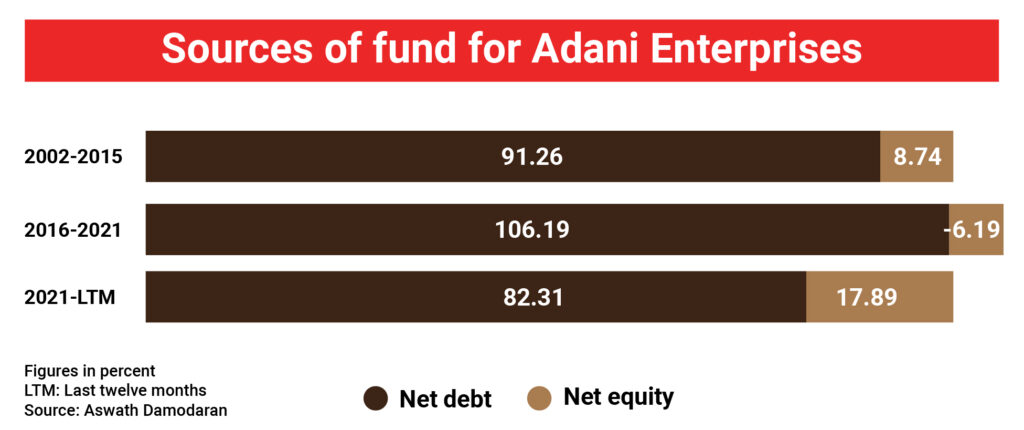

With Indian banks already accounting for around 32% of its total debt, going the debt route would be challenging for the Group. A quick study of the Group’s numbers reveals that the Weighted Average Cost of Capital (WACC) of the group’s flagship company Adani Enterprises is at 14%, while its Return on Invested Capital (ROIC) is at 3.15%. This denotes that the business is losing more money than it brings in, in effect a net loss. It would be safe to say that investor appetite will be muted for the short-term at least, and perhaps longer, thereby taking the equity option off the table.

Where can the Group turn then? Asset sales are an option, as are some creative financing options that can be pursued by floating a Special Purpose Vehicle (SPV). This is all theoretical, though. Take the case of Reliance Power. After completing their IPO, they weren’t able to raise funds from public markets for a very long time, and this led to their demise as debt levels became unsustainable.

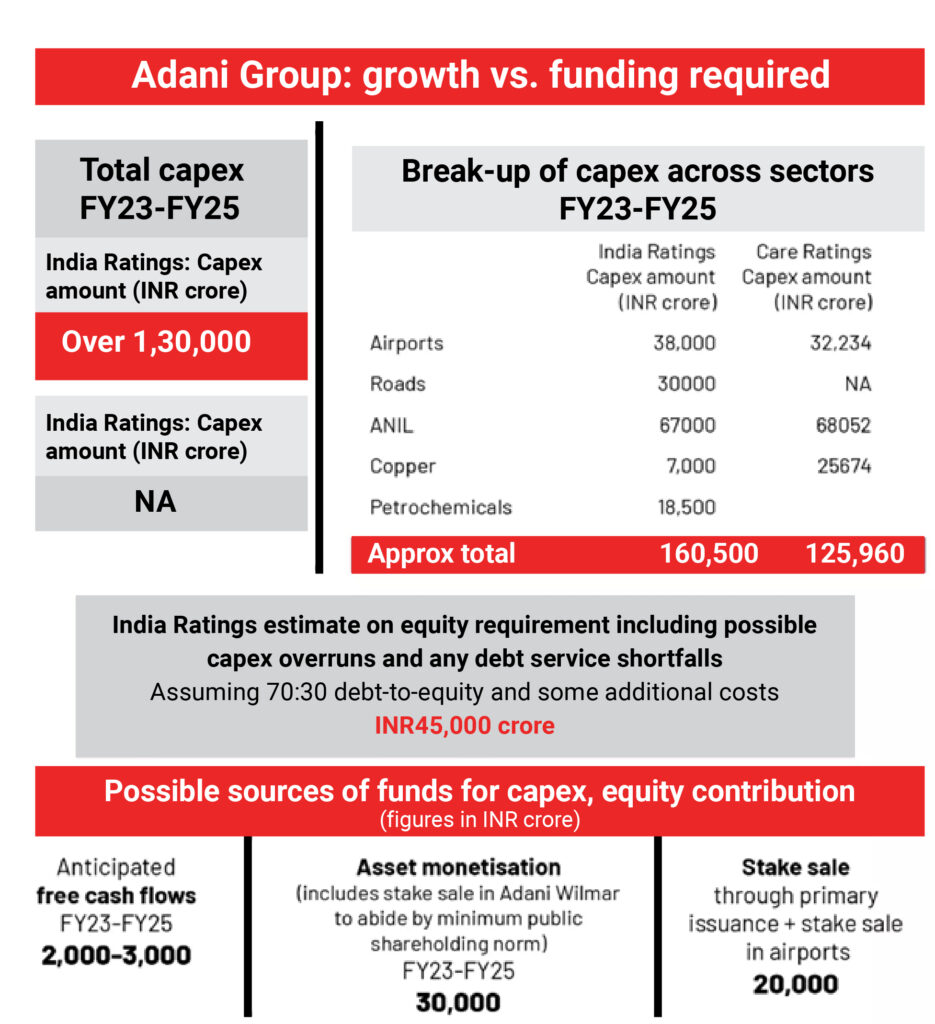

If one were to speak of Adani Enterprises, an India Ratings report in December 2022 stated that Adani Enterprises has a capex outlay of over INR 1.3 lakh crore over FY23-

FY25, for which it estimated the company would need an equity requirement of around INR 45,000 crore. This becomes a little more concerning when you subject the funding sources for Adani Enterprises to closer scrutiny (it is primarily debt).

While some might be raising alarm bells as leverage has gone up and yields drop for the company’s bonds, the possibility of default on interest payments seems a remote one, as Adani Enterprises has free cash flows of INR 1,000 crore – INR 1,500 crore annually. Besides this, the conglomerate has asset monetisation plans of over INR 30,000 crore, which includes a mandatory stake dilution in Adani Wilmar.

With some of the Group’s projects (particularly the ones taken over) set to generate cash flows after some years, and given that its fundamentally capital-heavy, utilitarian businesses are not the kind that historically offers exponential returns, it might be that the group will have to put its discretionary capex plans on hold in response to this new investment climate. Thus, plans to invest close to USD 60 billion from FY23-FY29, including an investment of USD 41 billion towards energy, and USD 10 billion for transport and logistics, might be put on ice for now.

A cautionary tale

Adani Enterprises is a significant flywheel of the Indian growth story, with the company accounting for total revenues of $25 billion (equivalent to 0.7% of Indian GDP), a net profit of $1.8 billion, and 7% of the capital spending of India’s 500 largest listed firms. The Group says it has enough cash to complete all of its under-construction projects, but its debt-fuelled growth model is being held to greater scrutiny.

This furore lays threadbare the risk of putting your eggs in one basket. India Inc. has been cajoled to invest in the development of critical infrastructure, such as roads, railways, airports and green energy. It is big business too, with Adani one of a group of enterprises (which includes Reliance Industries, Tata, and JSW) set to invest more than $250 billion over the next five to eight years in infrastructure and emerging industries. Even so, tying India’s growth story to the coattails of a tycoon seems to be folly.

This has the makings of a story India has heard of far too often; a business engine fuelled by credit has too often sputtered as costs soared, and cash flows tightened, leaving banks saddled with debt. Adani Enterprises cash flows might save it from going that route, but should his infrastructure investments struggle, the nation will yet again see half-finished projects lying about.

India is poised to enjoy a strong growth spurt amid a gloomy global economic climate, and if the country is to remain an attractive investment destination in 2023 and beyond and realise PM Modi’s ambitions to make the nation a manufacturing powerhouse, it is important that the country’s institutions and capital markets are seen as being completely above board. Any erosion of faith could be fatal, wiping the lustre from India’s allure, making absolute transparency and accountability a must, even for the biggest business enterprises.