The fabric of the global order is showing signs of fraying, putting India’s multi-alignment strategy firmly to the test

Words by Karan Karayi

A new global map is being drawn—not on parchment, but in ports, data corridors, supply chains, and military exercises. Power is no longer concentrated in one pole or split between two. It is diffused, disputed, and often disoriented. In this climate of flux, India is trying something few have attempted at this scale: strategic autonomy through multi-alignment.

The idea isn’t new, but the execution is increasingly complex. With tensions simmering from the Taiwan Strait to the Persian Gulf and a shadow war unfolding in cyberspace, India finds itself at the intersection of global fault lines—and with rare leverage.

As the old geography of power breaks down, India is helping draw the contours of the new one.

From fence-sitter to fulcrum

India once positioned itself as a neutral voice in a bipolar world, a legacy of its Non-Aligned Movement roots. Today, its role is more active—and more nuanced.

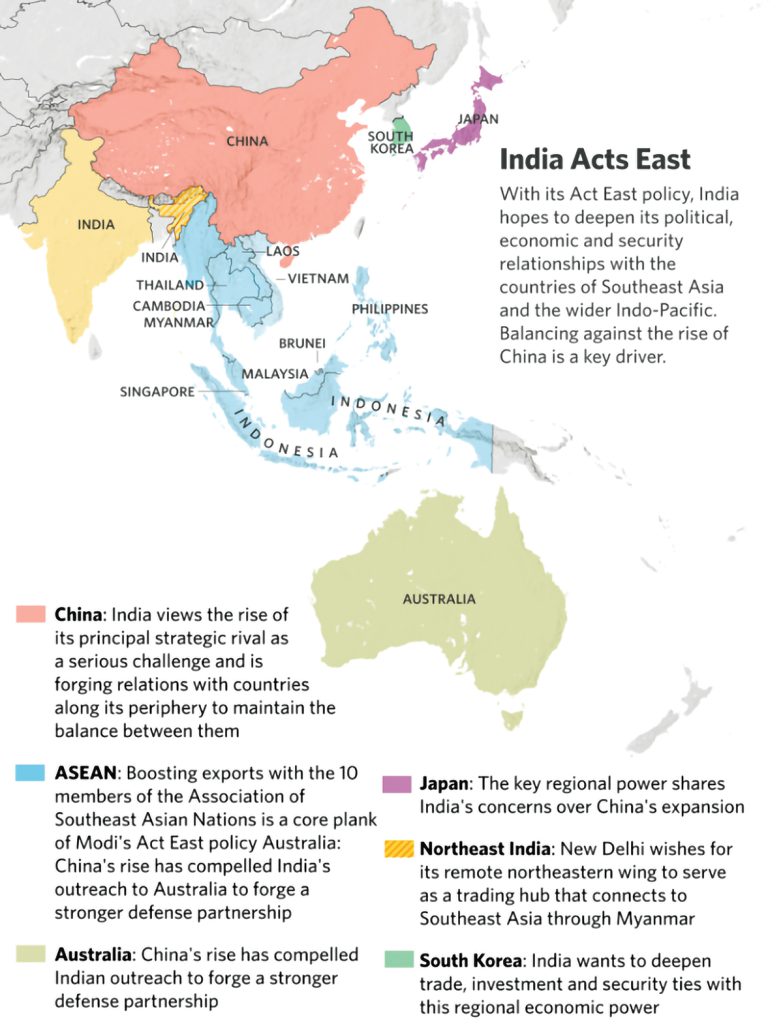

It signs foundational military agreements with the U.S. while purchasing S-400 missile systems from Russia. It abstains from UN votes on Ukraine, but expands defence ties with France. It’s a member of BRICS, yet also a Quad partner with Japan, Australia, and the U.S. It hosts naval drills with ASEAN countries and builds connectivity projects with the EU.

In a world demanding clear alignments, India offers strategic ambiguity with clear purpose. More than indecision, it’s insulation. And it’s gaining attention.

As French President Emmanuel Macron recently said, “India is among the few countries that can speak to everyone.” That access, cultivated over decades, is now India’s diplomatic capital.

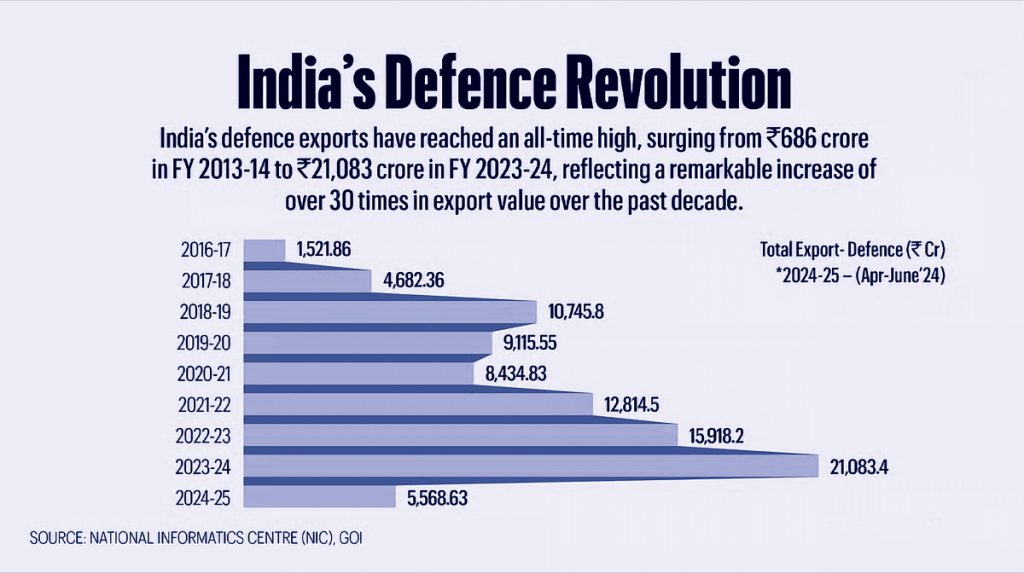

India’s Defence Evolution: From Procurement to Production

Over the past five years, New Delhi has not only become one of the world’s top arms importers, but has also aggressively pushed “Aatmanirbharta” (self-reliance) in defence. Licences for private sector weapon manufacturing have tripled. Defence exports crossed ₹21,000 crore (approx. $2.5 billion) in 2023–24—a record. Indigenous systems like Tejas fighter jets, Akash missiles, and Pinaka rocket launchers are now being shipped to friendly nations.

India is also leveraging co-production as a diplomatic tool. Agreements with the U.S., France, and Israel now focus on joint manufacturing and technology transfer. The recently signed roadmap with the U.S. under the iCET (Initiative on Critical and Emerging Technology) includes co-development of jet engines and AI-based warfare systems.

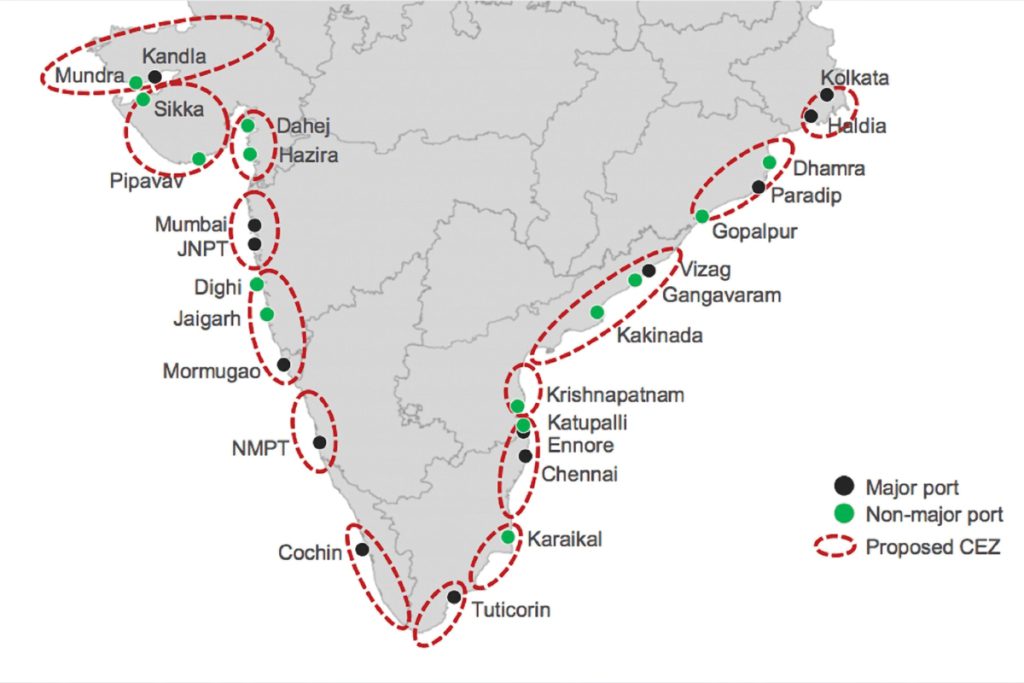

Meanwhile, naval expansion continues apace. The Indian Navy’s 200-ship plan by 2030 underlines its intent to be a serious Indo-Pacific player.

Mining Critical Minerals, and the Digital Frontier

Trade and diplomacy no longer hinge only on oil and arms. Increasingly, they hinge on semiconductors, data flows, and critical minerals.

India’s Digital Public Infrastructure (DPI) model, already celebrated for UPI and Aadhaar, is now being exported to countries in Africa and Southeast Asia. A Memorandum of Understanding with the G20 and the World Bank aims to globalise India’s DPI architecture, positioning it as a low-cost digital superpower.

Semiconductors are also becoming a national priority. With global chip demand surging and geopolitical frictions reshaping supply chains, India is setting up fabrication units with partners like the U.S., Japan, and Taiwan. The $10 billion chip incentive scheme, anchored in Gujarat and Tamil Nadu, is part of this push.

To secure the raw materials for such technologies, India is signing bilateral deals to source lithium from Argentina and cobalt from the DRC. An India-Australia Critical Minerals Partnership was inked last year to secure long-term access to rare earths.

This pivot from oil diplomacy to tech diplomacy is reshaping India’s external engagements—and future-proofing its industrial ambitions.

A trade map in motion

India’s trade strategy is finally catching up to its geopolitical aspirations.

It walked away from the RCEP in 2019, perhaps fearing China’s dominance. But since then, it has inked FTAs with Australia and the UAE, is in advanced talks with the UK and EU, and has restarted trade dialogues with the U.S. under the Trade Policy Forum.

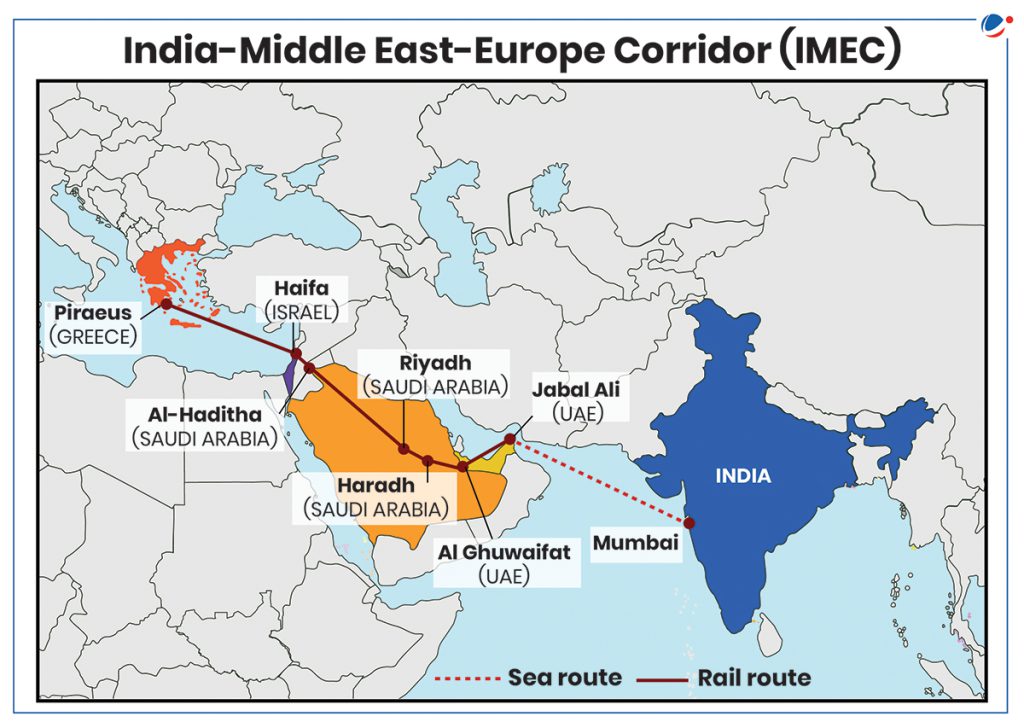

At the same time, it’s launching new trade corridors—most notably the India-Middle East-Europe Economic Corridor (IMEC), announced at the G20 summit in Delhi. This corridor, seen as a Belt-and-Road alternative, aims to connect Mumbai to Europe via the UAE, Saudi Arabia, Jordan, and Israel. It’s an audacious plan, and while execution remains a question mark, the geopolitical messaging is clear: India is staking a claim in the architecture of global trade.

India is also working to unlock value through service exports—IT, fintech, gaming, and space tech—all sectors where it has a talent edge. In fact, services now account for nearly 40% of India’s total exports, a trend that’s expected to continue.

Risks and realpolitik

India’s strategic balancing act is not without risks.

Russia’s war in Ukraine exposed the fragility of oil diplomacy. A potential second Trump term in the U.S. could once again weaponise tariffs, testing India’s economic resilience. Chinese aggression on the Line of Actual Control (LAC) remains a live threat.

Moreover, managing multiple allegiances has domestic political implications. Critics argue that India cannot indefinitely postpone hard choices—particularly in areas like data privacy, market access, and democratic values. As partnerships deepen, so will expectations.

And then there’s the Global South—where India wants to lead, but must also deliver. Chairing the G20 with a developmental focus won it praise, but implementation and follow-through will determine credibility.

Power Goes by Many Names

The phrase “global power” once evoked images of tanks, treaties, and trade surpluses. Today, it means all that—and more. It means the ability to shape data norms, direct capital flows, convene climate talks, and manage diverse alliances without being consumed by them.

India is not yet a superpower. But it is something else: an indispensable node in a networked world. A hinge nation between East and West, North and South.

As global power fragments and realigns, India’s strategy of multi-alignment is not just smart—it’s necessary. It offers the agility to pivot, the strength to say no, and the maturity to lead when asked.

For global executives, investors, and policymakers, India is as much a rising power as it is a rising platform. And in a world that is witnessing geographic pecking order of power being redrawn, it might just be one of the few stable points left to navigate from.