A return to trade brinkmanship spells uncertainty for India’s growth story

Words by Karan Karayi

The trade winds have shifted. Again.

Former U.S. President Donald Trump’s re-election—and his renewed appetite for tariff brinkmanship—has sent tremors through the global economic order. While the White House frames it as a campaign to “rebalance unfair trade,” businesses around the world are bracing for impact. And nowhere is this felt more sharply than in India, which finds itself caught between promise and peril.

For New Delhi, Trump’s tariffs offer both a strategic opportunity to assert its manufacturing ambitions and a sobering reminder of how fragile trade gains can be in a fragmented world.

The tariff king meets the tariff man

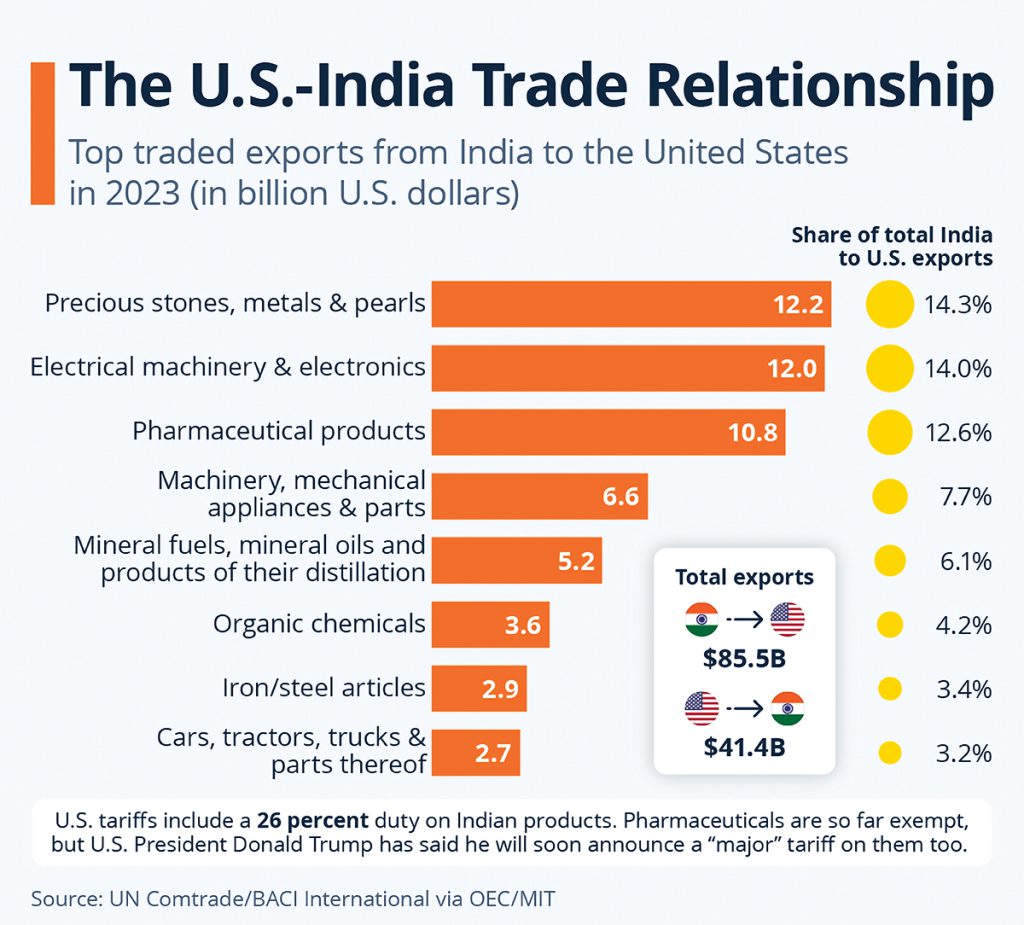

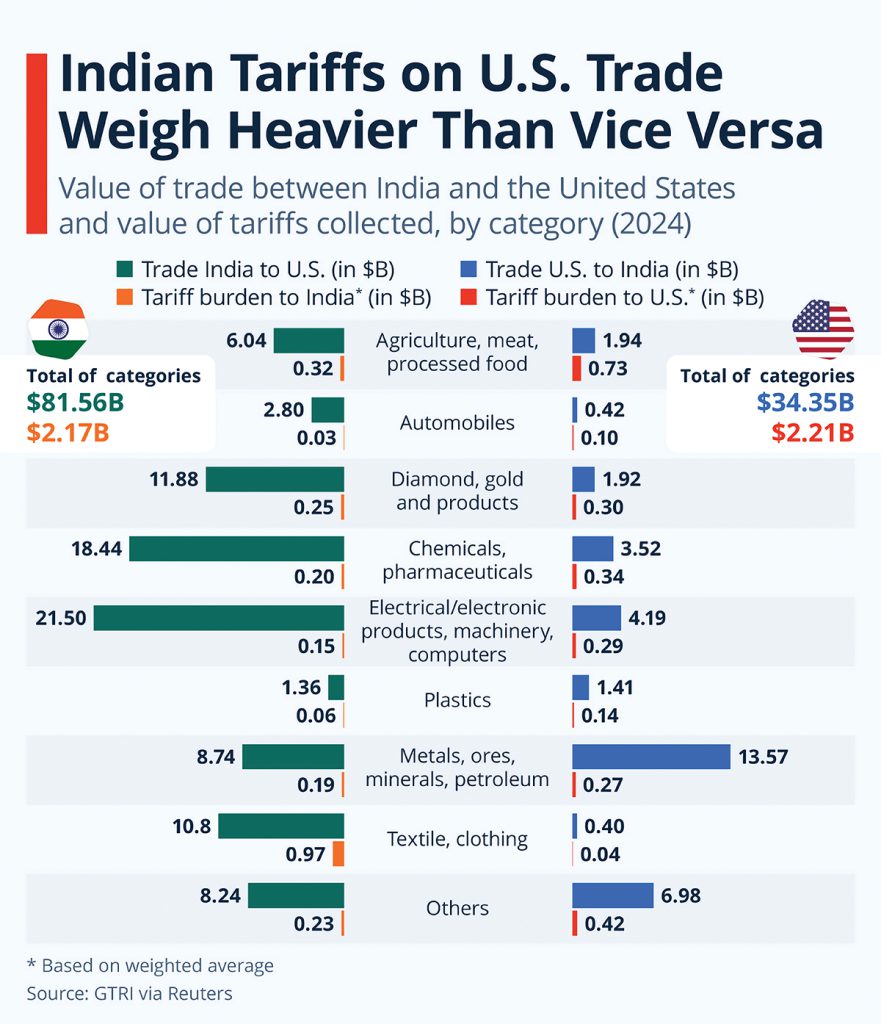

Trump’s latest volley of “reciprocal tariffs,” including a steep 27% duty on Indian goods, hit a nerve. The move came despite years of trade diplomacy between the two countries, with Indian officials offering concessions on bourbon, motorbikes, digital taxes, and satellite internet access. Commerce Minister Piyush Goyal even promised broader tariff cuts in March, covering more than half of all U.S. exports to India.

Still, the hammer came down.

India’s response? Strategic restraint—for now. No retaliatory duties, no fiery rhetoric. But behind closed doors, the talk is different. Officials have flagged a WTO complaint, and there’s rising pressure on New Delhi to protect sectors like electronics, seafood, and textiles, all of which stand to be hit hard by shrinking U.S. demand.

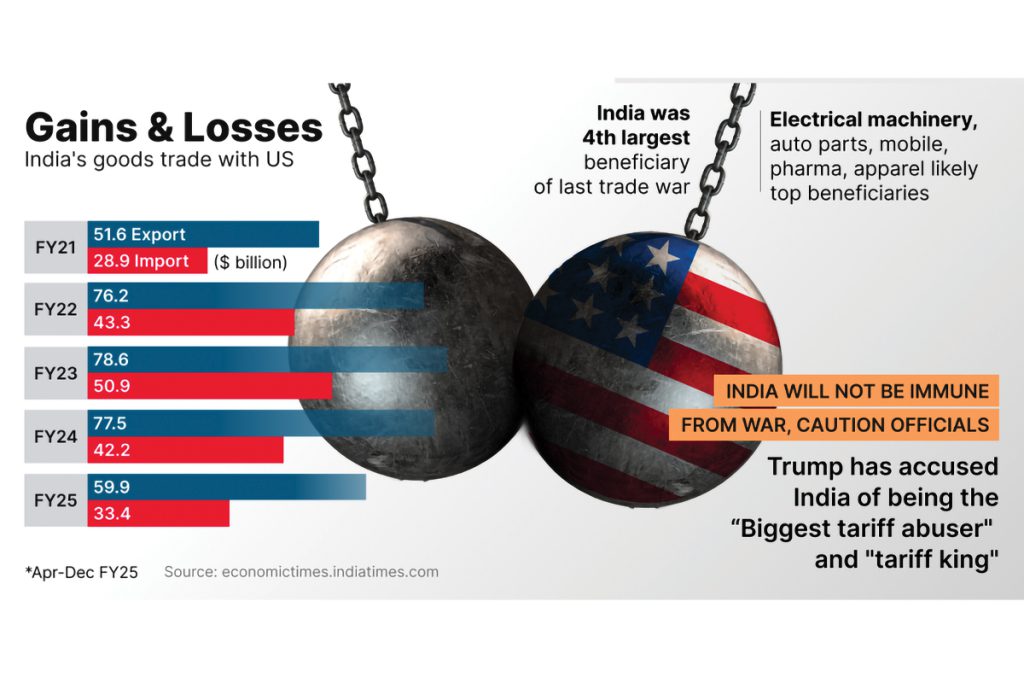

And that’s before considering the indirect pain. Slower global growth—an inevitable outcome of extended trade wars—will dent Indian exports, increase competition, and potentially shave nearly 0.8 percentage points off GDP growth, economists warn.

From China Plus One to Cold Shoulder

Initially, Trump’s trade war with China had seemed like a once-in-a-generation opening for India.

The logic was simple: as American firms fled Chinese tariffs, India could swoop in to claim the manufacturing mantle. Some of that did happen—Apple now sources a growing number of iPhones from Indian plants, and India’s production-linked incentives (PLIs) were designed to draw in deeper supply chains.

But as U.S.–China relations began to thaw—with Washington signing temporary tariff truces with both Beijing and London—India’s advantage began to erode. The Federation of Indian Export Organisations now warns that reduced U.S.–China tariffs have “closed the competitive gap” India briefly enjoyed.

Even more worrisome? Global firms are holding off deeper investment in India’s manufacturing base. “While low-investment assembly operations may linger,” said Ajay Srivastava of the Global Trade Research Initiative, “deeper manufacturing—real industrial ecosystems—may stall or even return to China.”

Make in India: Promise under Pressure

The numbers tell a sobering story. India’s goal to boost exports to $2 trillion by 2030 looks increasingly ambitious. The manufacturing sector—despite PLIs and import controls—still hovers around 14% of GDP, down from 16% in 2015. Private investment remains sluggish, and FDI has declined year-on-year.

Meanwhile, New Delhi faces tough questions from global partners. Can India open sensitive sectors like agriculture and e-commerce to strike trade deals? Can it scale up quality manufacturing fast enough to be competitive?

Trump’s renewed trade nationalism adds fuel to that fire. If the U.S. demands greater access to Indian markets—especially in government procurement, digital services, and data flows—New Delhi will have to weigh strategic openness against domestic political backlash.

Farmers, small retailers, and powerful corporate lobbies remain deeply sceptical of deeper liberalisation. Any misstep could erode political capital ahead of elections.

Diplomacy in a time of Decoupling

India’s strategy, for now, seems to hinge on diplomatic diversification.

Trade talks with the EU and the UK are accelerating. The UAE and Australia have already signed FTAs with India. And New Delhi’s involvement in initiatives like the IPEF (Indo-Pacific Economic Framework) signals a broader pivot to trusted, rule-based commerce.

But the U.S. remains India’s largest export market. Over $210 billion in bilateral trade is at stake—and far more in terms of shared supply chain ambitions, energy partnerships, and defence technology collaboration.

This makes the current moment unusually precarious. The Trump administration has used trade not just as policy, but as leverage—including during the recent India-Pakistan flare-up. His comment, “If you don’t stop fighting, we won’t trade,” has not gone unnoticed in South Block.

New Delhi has firmly denied any such ultimatum—but the episode highlights how trade ties are increasingly entangled with geopolitics.

A resilient India? Or a reactive one?

The question now is whether India will stay the course on economic reform—or retreat into protectionism once again.

There are signs of flexibility. Piyush Goyal recently warned Indian exporters to shed their “protectionist mindset.” Reports suggest India may let its PLI scheme lapse, indicating a shift toward more market-led competitiveness. But change will need to go deeper.

India’s edge cannot come from being “the alternative to China” alone. It must be built on regulatory clarity, infrastructure strength, logistics ease, and scalable human capital. Until those fundamentals align, tariff wars will remain storms India weathers, not ones it commands.

In Uncertainty Lies Opportunity

Tariffs, in themselves, aren’t new. But in a global economy marked by climate transitions, AI acceleration, and growing multipolarity, their weaponisation is.

India’s task is twofold: protect its short-term export interests, yes—but also build long-term resilience through structural reform, diversified trade, and nimble diplomacy.

In Trump’s tariff era redux, India cannot afford to be a passive recipient of global winds. It must steer through them.